Best Credit Repair Companies 2025 – Honest Credit Repair Reviews and Actual Results | Our Top 7 Choices

Best credit repair reviews – Are you interested in hiring a credit repair company to raise your credit score? Choosing the right credit repair company can mean the difference between thousands of dollars and hours of wasted time. There are endless amounts of credit repair companies out there, and they all claim to offer the same thing: a higher credit score at a low cost. But which of these credit repair companies truly do offer what they say they do? We have the answers. After conducting extensive research on all of the top credit repair companies out there, we have compiled a list of which ones are the best. Instead of doing a top ten list, we decided that we could only affirm, vouch for and endorse seven of the best credit repair services . Each service that we feature, we have actually used first-hand by our founder, someone in our company or by someone we know and the results have been documented. Disclaimer: If you sign up with one of these services through our site we may earn a commission (but not on all). It is more important that we are ethical, upfront, and transparent in our findings and that you can trust our reviews to help you make the right decision about which credit repair company to choose.

#1 – Sky Blue Credit – Sky Blue Credit is a reputable trusted company that has been repairing credit for many years. It is, from our hands-on trials and findings, the #1 overall best credit repair company. We have also chosen them as #1 for fast credit repair.

No-Nonsense | No-Pressure Courteous Team

They are comprised of a team of credit specialists that are extremely courteous and professional. If you’re looking for a credit repair company that has repeatedly shown successful results for years and years, then Sky Blue is a great option!

How Do We Know That They Work?

Because we’ve used them and we have proof of the results.

That is why they are our #1 choice for credit repair. See actual deletions that they have acquired for us.

Also, see our in-depth review of Sky Blue Credit.

A+ BBB Rating and a 90 Day Money-back Guarantee

To add to your confidence level, it doesn’t hurt that Sky Blue has an A+ BBB rating after 25-plus years of being in business!

And you want to use a company that backs up their service with a full 90-day (no questions asked) 90-day money-back guarantee.

A Case Study

Our Founder of this site CreditRepairReviews.co, Charlie, used Sky Blue and had over 30 deletions!

See more of Charlie’s story here.

Another close colleague of ours used Sky Blue with great results. After 7 months, his Fico Score went from 601 to 733 with 17 deletions of negative items (4 of which were charge-offs).

They have also helped other members of our team. See more of what Sky Blue has done for us! Visit their website for more information.

Sky Blue is a very trusted name in the industry. You can move forward with them to repair your credit with confidence!

Here’s Why Sky Blue is the Best Credit Repair Company

Take action now!

Phone: 407-349-8847

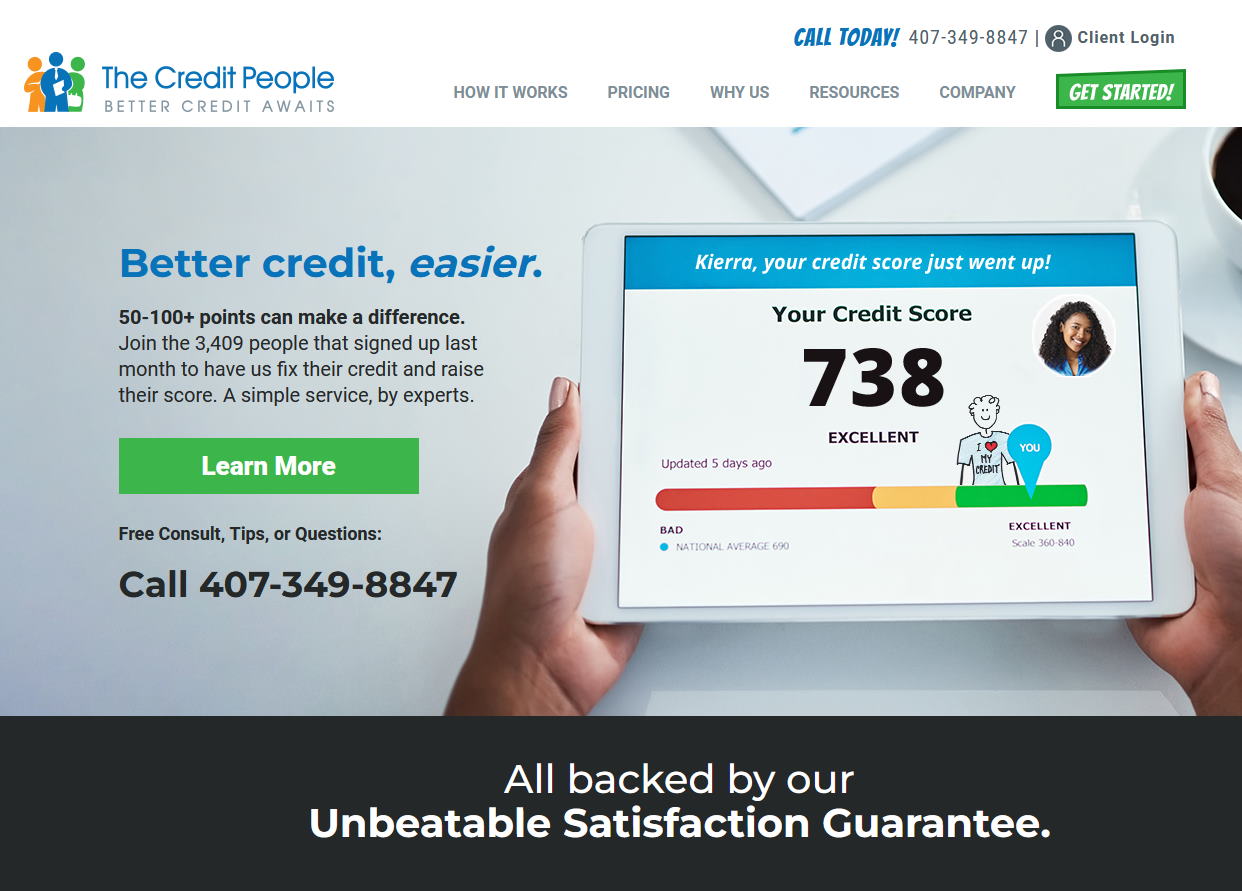

Our #2 Overall Pick | The Credit People

Affordable Experienced Professionals

With years of credit repair success under their belts, the Credit People are up for the challenge to help you raise your score, and in turn, raise your status.

The Credit People are true professionals and they are one of the least expensive companies on our list. Get into their program for a low monthly fee, and boost your score today.

You can even receive a free report and a free credit score through their website!

How The Credit People Helped one of our Colleagues

We can attest that The Credit People’s unique program is one of the fastest, best, and most affordable restoration services available online.

One of our colleagues tried the program (When their company name was DSI) with amazing results.

They realized 18 deletions in total, including a bankruptcy! See our full testament of The Credit People on their company profile page.

Call 407-349-8847 today to get started!

Phone: 844-694-0646

Our #4 Overall Pick | The Credit Pros

Customer support that is second to none

The one thing that you can be sure of is that The Credit Pros will treat you in a courteous and professional manner. You will have full transparency on your account and you will know exactly what has been done each step along the process and your private information will always be 100% secure.

A true boutique company

You will also get the best customer support. Someone will always be there to help you or to answer your questions. Trust us, this is not extremely common with other companies. You will also get fully customized handwritten letters They do not print out generic letter campaigns as most of their competitors do.

Advanced technology

The Credit Pros are also ahead of their time with advanced AI technology (CreditRepair.ai™), and CreditSentry™ where your credit reports will be monitored in real-time by Transunion.

Learn more about their advanced features here.

What The Credit Pros Accomplished for two of our Colleagues

We have a great testimonial from a colleague where The Credit Pros realized 15 deletions in five rounds of disputing. Her score went from 601 to 721.

Another colleague had 9 deletions in just two rounds with their “success package” which cleaned up his reports across all three bureaus (Transunion, Equifax, and Experian) and helped him to get approved for a mortgage. The Credit Pros were able to get a tax lien and three collection accounts removed because of inaccurate reporting.

Our #4 Pick | Lexington Law

Another Real Case Study

Our #5 Pick | CreditRepair.com

How they helped us

Our #6 Pick | Ovation

What they did for us

Credit Repair

Credit Repair is your right

Making sure that your credit information which is being reported about you by third-party agencies is your right under the law. Although many people think that credit repair is not possible or that using an online credit repair company is illegal or may be a scam, the fact remains that hiring one of these online credit repair companies is completely 100% legal, and is your right under the Fair Credit Reporting Act (FCRA). Many consumers do not know but the FCRA actually supports your ability to dispute negative erroneous items on your credit report.

Credit repair is possible

Chances are that by now if you’ve been searching on the Internet, you have seen many articles and discussions that state that credit repair is simply not possible. Many of these articles state that only time and paying bills responsibly is the only way to repair your credit score.

This is of course very sound advice and is of course also very true, but it is not the only way to raise your credit score. You are allowed by law, to dispute any and all items on your credit report. This is your right. It is the right of every consumer, and this law was created for your protection.

Wouldn’t you want the fair chance to remove items that really arent yours?

Let’s think about this for a moment. If an erroneous item was appearing on your credit report and it truly was not yours, wouldn’t you want the chance to have that item removed? Of course, you would, and, it’s only fair. And thanks to the laws that are in place to protect you as a consumer, you have the full right to do this and act upon this on your own. All you would have to do is dispute the negative item with the credit bureau. You would write a letter that simply states that this particular negative item is not mine.

The credit bureau then must take action and research your dispute. If they cannot find any evidence of this negative item truly being yours, then by law, they must delete the item from your credit report.

The credit bureaus do not know whether or not your dispute is frivolous. They have to determine that by doing their research. Now I am by no means suggesting that you send in frivolous dispute letters. You do not need to make up crazy stories or lie. You simply need to have the credit bureaus prove that every single negative item appearing on your credit report is actually yours.

You have the right to double-check any information at all, that you feel is inaccurate, which is showing up on your credit reports. Remember that the three major credit bureaus are independent companies that are buying and reselling information about you to creditors, lenders, and banks. You did not ask for this credit information to be compiled about you but it is and the laws are in your favor to ensure the accuracy of this information.

Believe it or not, it is up to you and you alone to make sure that the information provided about you is accurate. If you feel that anything at all is not accurate, or looks even remotely fishy on your credit reports, you should dispute them with the three major credit bureaus immediately. If you don’t recognize a particular item or a particular creditor; or even if your reported available credit line is not accurate, you should dispute it straight away.

Your credit report changes every single month. Every month your creditors update specific information about you and report it to the credit agencies. They update everything that they know about you including your account balances, inquiries, your recent payments, and existing credit lines, so you should be checking your credit report all the time to make sure that all of the information is 100% accurate. We would suggest checking the information reported about you at least once every two months at the very least.

Remember repairing your credit is your right by the law

This is your right. Why not take advantage of it. By law, your creditors (and the credit reporting agencies) must prove that everything appearing on your credit report is actually yours. You can dispute items on your own or you can choose from one of our recommended online credit repair services to do the work for you. Our recommendations are backed by real results where you can see previous actual deletion letters. The advantage of hiring a credit repair service is that they know the laws in each and every state and are able to expedite this matter for a small fee.

To really keep on top of what is going on, you have 2 simple choices…

We Have Been Providing Credit Repair Company Reviews for over 15 Years

So we know a thing or two! (That sounds like the Farmers commercial). :)

But seriously, we realize that having bad credit is a consequential problem and that there are many consumers out there that are not sure which road to travel on, and they are not sure how to deal with and fix it. Should they try to do it themselves or should they look for a reputable company that will genuinely have their best interests in mind?

Both options are viable and we aim to help you to do either or.

If you want to repair your credit yourself, we are here for you with plenty of resources. All you have to do is learn the laws and then learn how to write a dispute letter.

If you don’t have the time or the know-how, we want you to trust have in us with the unbiased and factual reviews that we have backed up with real evidence.

Take a look at our case studies and in-depth reviews. Check out who we have determined as the best credit repair companies.

We are your #1 trusted resource in repair for finding legit companies that provide commendable credit repair services.

We are not just another top ten credit repair companies website.

Please take the time to look around and we think you’ll agree.

Navigating Our Credit Repair Resources and Reviews

What’s new on our site? (Updated 1-13-23)

Welcome to CreditRepairReviews.co! We are always updating our site with fresh relevant content for our visitors. We want you to trust in us so that you can rely on the accuracy of our information. We are always here to help you with repairing your credit and getting out of debt. Thank you for visiting!

Here it is! The unbound utmost conclusive lest ever created of the best marketing tools. There are tools that digital business owners cannot live without!

It’s finally here. Our all-new 130+ ways to get out of debt blog post. Included are some amazing tips on eliminating debt while learning how to save money. There is also a section on ingenious ways to make money fast. We’ve worked hard on this material and we think you’re really going to like it! Check it out here.

We’ve just updated CreditRepair.com’s new pricing model.

We have just fully updated our 10 Step credit repair guide with more in-depth information to give you a better understanding of how to repair your credit, whether doing it on your own or by utilizing a credit restoration program or service.

If you have been considering starting your own credit repair business, check out our fully updated review of the best Credit Repair Cloud software. We have added all of their options including their free 30-day trial of the software and their free training class. This is a must-read if you want to start your own business. Credit Repair Cloud has just launched a brand new robust version of their software with tons of upgraded features. See our in-depth breakdown of the all-new Credit Repair Cloud 2.0 software. There are a lot of really cool new features in the 2.0 release. You’re going to love it!

Here are our 15 latest blog posts:

How often can you get a free credit report – You can get a free credit report from the three major credit bureaus once a year. Learn how in this quick blog post!

Raise your credit score 100+ points overnight – See our latest blog post on how you can raise your credit practically overnight. There are seven great tips on how to get the job done quickly. If you need a quick boost in your credit score then you’re definitely going to want to read this post. We truly hope it helps you in your endeavors to raise your credit score!

Money affirmations that really work – Learn how to use the power of positive affirmation to manifest money and success into your life.

Inc Authority reviews – Calling all entrepreneurs! Get your LLC or Corporation set up for free! Read our in-depth review to see everything that you can if you sign up with this company to get your business entity off of the ground.

If you want the real truth about credit repair, we’ve got answers to the most common misconceptions. See our latest record release :) credit repair myths exposed.

How to remove paid collections from your credit report – See 4 sound strategies on how to get stubborn paid (or unpaid ) collection accounts removed from your credit reports.

Does requesting a credit line hurt your score? In this latest article, you will learn whether or not requesting a credit line increase will hurt your fico score. You will also learn how to utilize and leverage a simple strategy to raise your credit score overnight!

If you’re looking to start a successful freelance affiliate marketing business, or if you want to build an affiliate downline for your credit repair business, you’ll want to check out this amazing 15-day course from Legendary Marketer. The course is just $7. And trust us it’s well worth it. Founder Dave Sharpe has done a really great job by over-delivering with value with this one!

Here is an amazing offer that we just love promoting because it helps consumers to pay off their mortgage and all their other debts in as little as 5 to 7 years! The Software is called the Money Max Account. See how you can get out of debt in 5 to 7 years and build wealth at the same time.

If you are a small business or a start-up entity and you need business credit, we have great news for you! We’ve partnered with Fund and Grow, a company that will help you to get uncollateralized business credit cards at 0% interest with no tax returns or financials required. See our full review of Fund and Grow and learn how it works. Trust us, you’re gonna like this!

We have put together some really clever goodwill letter templates that you can use to get late payments removed from your credit reports. We explain some of the best strategies so you have a better chance of successfully getting the late marks removed.

Here is our brand new resource of where to find the best online education. Included are our hand-picked recommendations of the best courses and training to help you become an expert in your field.

Do you want to sharpen your digital marketing skills? We’ve got you 100% covered! We have just created an amazing marketing section where we offer tips on how to grow and scale your business as quickly as possible.

Moosend – Read our full review of this all-in-one email marketing platform. If you are not actively working on your email marketing, now is the time to start. Moosend can get your email marketing off of the ground quickly and easily!

Kartra – Could this be the #1 absolute best all-in-one marketing tool for running your online business? Read this review and find out! With so many features under one roof, Kartra is making a run to be one of the best all-in-one marketing software products ever created!

Our All-New Guide to Getting Out of Debt

We are not just credit repair anymore! We have just launched our all-new debt help guide!

And we’re not just saying this, you’re going to love it! We have uncovered tried and true techniques that will help consumers not only just get out of debt but to build wealth at the same time!

Please take a moment to visit our three latest debt help posts

How to get out of debt – If you’ve been dreaming about finally becoming debt-free, this is the page that you want to read first! Using our strategies, you can learn how you can get rid of all of your debt anywhere from 2 to 7 years. By the way, these strategies do really work. So if you have been longing to get out of debt, make sure you read this post. It can change your life!

How to pay off your mortgage early – How would you like to pay off your mortgage in 5 years instead of 30 years? Well, now you can do just that! Not only will you be able to pay down your mortgage but you will also be able to pay off all of your existing debt including credit cards, personal loans, car loans, you name it! Get rid of your debt forever with these amazing tried and true strategies. You can become fully debt-free and you can start building a stream of wealth well within just 2 to 5 years by following our strategy. Don’t wait. Now is the time to get of debt entirely, forever, and for good!

Best debt elimination software – We have found an astounding company that offers a unique proprietary debt elimination software that uses sophisticated algorithms to get you out of debt in just a couple of years. Please take the time to fully read our reviews of the best debt trackers and debt elimination software. Getting out of debt has never need easier thanks to modern technology, science, and mathematical algorithms.

Hey, debt sometimes happens because of unseen circumstances. Just know that you can rebuild. We are always here to help you with support on any level. Please feel free to reach out to us with any questions or comments. We love feedback and we love helping our visitors to find their way by increasing their credit scores and completely getting out of debt while building wealth. Don’t worry. You’ve got this!

Entrepreneurial resources:

How to start a credit repair business from home – For all of you entrepreneurs out there. Here is the one and only insurmountable guide that will take you by the hand and walk you through actionable tasks, step-by-step, from A to Z, on how to start your own credit repair business. You can start your own lucrative profitable business with very little overhead. Imagine being self-employed while helping others to improve their credit scores so that they can get the loans, credit cards, and mortgages that they need! We have just added some great ideas on how to grow and scale your business very quickly!

Get your business entity formation for free! Learn how to start your business for free.

Business credit repair software – Get the lowdown on the best credit repair software to use to manage your credit repair business.

Credit Repair Laws and Loopholes – See the loopholes and laws that you can use to fix your credit legally, efficiently, and quickly. There are no tricks here, just some really good treats that you can use to repair your credit, and they (these loopholes) are backed by the law.

Start your very own debt-to-wealth business – Get paid anywhere from $500 to $1,500 per sale just by sharing award-winning debt-elimination software! You can finally become your own boss and build up a big team! This is an amazing lucrative opportunity. You can show people how to completely eliminate their debt and turn that previous debt into instant wealth. This may very well be one of the best businesses of the 21st century.

Check out our complete guide for entrepreneurs. This guide was created specifically for entrepreneurs that are looking to get into the credit repair business. If you are serious about starting a business, we highly recommend that you take the time to go through this section of our site. You will find a lot of useful start-up ideas and marketing tips.

Credit repair reviews | Credit repair resources reviews

See our top picks of the best credit repair companies. Also see a list list of all credit repair companies in order from best to well, not so good.

Credit repair help

See our resources where you can get credit repair help. Here you will find answers to your credit repair-related questions.

Visit our blog for more answers to everything credit repair.

About us | Contact us

Learn more about us as a company.

Want to reach out to us? We love feedback! contact us today!

Which is the best credit repair company

What is the #1 best credit repair company? Our #1 choice is Sky Blue Credit Repair because they do not have a pushy sales team. They are rated high with the BBB and they also offer a 90 day full money back guarantee. They also get the job done. See our post does Sky Blue Credit Repair really work?, and also see the Sky Blue Credit Repair BBB rating with the Better Business Beauru. See third party ratings, reviews and testimonials of Sky Blue Credit Repair.

What to look for and watch out for when choosing a credit repair company

Due Diligence

Use due diligence and do research about the company.

Our site helps you to do just that.

The credit repair company should have good reviews

Choose a company that has a lot of experience with repairing credit.

The company should have a positive track record online with few or no negative reviews and should have a positive track record with the BBB.

The BBB is a 3rd party organization that helps consumers and businesses to resolve disputes. Accredited businesses that join the BBB support what the BBB does and they pay a yearly fee which helps the BBB offer its services to consumers for free. Not all businesses are accredited with the BBB but they may still have a grade rating (Of A, B, C, etc.) and you can still read reviews, customer complaints, and any disputes filed against them. You can then see how the disputes and claims were handled by the company.

Money-back guarantee

Choose a company that is willing to back up its brand with a no-nonsense moneyback guarantee.

There are no guarantees with credit repair but you want a company that is willing to put its money where its mouth is.

Make sure that they do not charge upfront fees

Never hire a company that charges you upfront fees.

It is for your protection that credit repair companies must start and perform some work for you before you pay them.

Are they making false claims?

Some unscrupulous credit repair services will falsely claim that they are affiliated with, and have an inside connection with the credit bureaus or that they are partners or allies with some sort of governmental agency. Beware of these declarations as they are both fraudulent assertions.

There is no such thing as guaranteed results

Beware of false claims of guaranteed results. There is no such thing as guaranteed results not just in credit repair, but just about with anything in life. They have not even seen your credit file yet. They do not know your situation and they do not know if there are any inaccuracies on your credit reports. How can they guarantee results? Run as fast as you can from these types of companies.

Promising to get you to a specific score

If they tell you that they will surely be able to get you a 750 credit score, again, run away as fast as you can. These are simply more false claims. Again, no company can guarantee you a specific score.

Promising to remove your accurate delinquent information off of your credit score

Although it is true that this is possible with some of the credit repair laws and legal loopholes that exist for your protection, however, the chances are unlikely, and telling you that they will do so is an immoral and untrustworthy claim.

Failing to tell you that you have the right to repair your own credit

You can dispute with the credit bureaus yourself. If they tell you that either you cannot do it on your own or that it would be a lot harder for you to do it yourself, they are lying.

They tell you not to directly contact the credit agencies

You have every right to do so.

They tell you to give incorrect information on credit applications because it will help you to get a loan

They are downright telling you to lie. How is that trustworthy?

Promising to create you a new identity

Watch out if a company says they can create you a new identity, and social security number so you can start off on a clean slate. This is an illegal activity and you could end up in prison.

Is the pricing reasonable?

Make sure that the pricing is reasonable and affordable.

Is there customer service good?

Are they giving you a lot of value? Does the information sound reasonable? Are they giving you the answers to your questions without being pushy? These are all good signs that they are a reputable firm.

Free consultations

The company should offer free consultations and absolutely should not have pushy salespeople.

We feel it is very important that you call and talk to a professional that represents the company (and not just a salesman) before you invest in their services.

If you are feeling like you’re being pushed into something, chances are that you are, and chances are that something that they are doing is not in your best interest.

You want a company that will go over your finances and credit situation and covers every single step of what will (or may) happen with your account.

They need to build trust with you.

Do not feel pressured into making a decision. If it doesn’t feel right, well then, it probably isn’t. Trust your intuition.

The one company that we can attest to that checks all these boxes is Sky Blue Credit Repair.

Also, see actual Sky Blue Credit – Credit bureau deletion letters that the company has achieved for us.

What to Expect From a Good Credit Repair Company

Honesty

A good credit repair company will be personable and honest with you and not just simply treat you as a sale.

Your trust in them

They will have the power of attorney to dispute negative items on your credit reports for you.

All of your information must be 100% correct and 100% verifiable

They will go through your credit reports with a fine-tooth comb and they will know exactly what to dispute for you. All of the information that is reported about you from the three credit bureaus must be 100% correct. If there are any discrepancies whatsoever the items must be removed.

They will know the laws

A really strong company like sky blue credit will know all of the legal loopholes and laws so that they can get items that are not compliant with the law be removed from your credit reports.

Money-back guarantee

They will offer you an ironclad moneyback guarantee

They will not charge upfront fees

It is illegal for a credit repair company to charge you before they start working on your case.

They will not charge extra for services that should be included

A good credit repair company Sky Blue Credit Repair will never charge extra for additional services.

Here are some of the things that a credit repair company can do for you

We Thank You For Your Trust

Our reviews of the best credit repair companies are 100% real and are backed and verified by real actual results that we have received by paying for and using these companies firsthand.

We are a New Jersey-based company and have also reviewed the best credit repair companies in NJ.

Learn more about our founder, our story, and our overall mission as a company.

Thank you for visiting and trusting our site.

We’re glad you’re here!

And we hope we can truly help you to make an educated choice with repairing your credit and improving your financial future.