130 + Ways to Get Out of Debt | Brilliant and Ingenious Ways to Eliminate Unwanted Debt, Save Money and Make Money! | How to Truly Get out of Debt

“Debt” can be difficult to overcome. It can haunt you for a long, long time. Being in debt can add a lot of weight, pressure, and undue stress to your everyday life.

Debt can be an unfortunate result of life-changing events such as sickness, divorce, loss of a job, or birth of a new child, and even a pandemic among many other reasons.

Falling into debt usually affects really good, conscientious people.

Although you may think it’s impossible to get out of debt, we want you to fear not!

We are here to help you with unique ways to counteract and fend off debt. We will show you how to get out of debt for good, how to save money, and how to make money!

By using the following strategies, we will not only help you to make your life free of tension, but we will also show you how to save a large amount of money.

Let’s get right into this!

OK, so let’s first start with some real ways to get out of debt.

Here are the best ideas & strategies to get out of credit card debt (and save money)

1. The debt snowball strategy

With this strategy, you are going to make the minimum payments on all of your credit cards (or other monthly debts) except for the smallest one. You will pay as much as you can on the smallest one until you pay it off in full. This is called “snowballing”. This method will help you start paying off all of your smallest debt first, then you move on to your next smallest debt. PS make sure when you pay off the smallest debt, do not use the card anymore during this process.

This strategy also keeps you motivated to pay off one that at the time instead of worrying about all the multiple debts that you have.

2. Lower your interest rates

Call your creditors and ask them for a lower interest rate or shop around for a card with a better rate and transfer the balance.

3. Consolidate credit card debt

If you are in a situation where it is possible to get a consolidation loan with a lower interest rate, do it. But be careful not to run up your credit cards again.

4. Pay Down Your Credit Cards

Pay off your lowest balance credit card first and put it in the drawer. Then concentrate on the next one with the lowest balance.

5. Make more than minimum monthly payments

Pay more than the lowest amount due so your debt does not keep doubling over time.

6. Pay off higher interest rate cards first

Getting rid of high-interest debt first will help you to get out of debt quicker.

7. Pay more on your car loan each month

If you pay more on your car loan each month, it will be paid off sooner and you can focus on paying off other debts.

8. Pay more on your mortgage each month

8. Pay more on your mortgage each month – Paying more on your mortgage will alleviate the potential need to take out a second mortgage in the future. See how to pay off your mortgage in just 5 years!

9. Settle your debt

You can contact your creditors and see if they will make a deal with you without it affecting your credit score. We do not recommend using a debt settlement company because using one will almost always damage your credit

10. Cut spending

Do not spend as freely as you once did. This means buying fewer luxury items and making fewer unnecessary purchases.

11. Ask for waived or lower fees

Do not hesitate to ask your bank to waive a late fee or set a lower fee on your credit card. You never know what they’ll agree to.

12. Balance your checkbook

A balanced checkbook will help you know where your money is being spent. Use a spreadsheet to balance your checkbook.

13. Refinance

Refinance your car or mortgage with a lower interest rate if possible because it will help you settle your debt quicker.

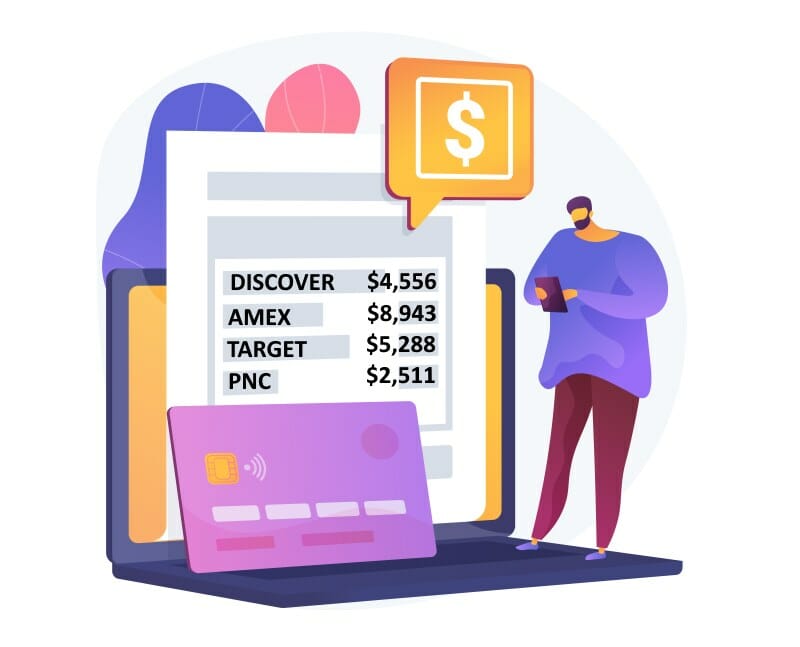

14. Know your debt

Many people either go into denial or think that they are in less debt than they actually are. Create a chart or an Excel spreadsheet and put all of your debt in there.

15. Get organized

Here is a great way to pay your bills. Make a spreadsheet with all of your expenditures and put them in date order.

16. Plan out payments

16. Plan out payments – Once you know what debt you have, you can plan out how you will pay back all of the money. This may mean paying one thing off first and moving forward from there or paying a little bit of everything as statements come through.

17. Stop carrying and using credit cards

It is easy to use a credit card for everything, but debt can quickly pile up so ceasing use of your cards might be a good idea. You can’t use your credit cards if you don’t have them on you. If the temptation is still too great, then freeze them in a block of ice!

18. Give yourself a spending limit

Even if you are only spending with cash, the more you spend, the less you will have to pay back your debt. A weekly or monthly spending limit will keep you on track.

19. Do not stress about your debt

Take everything one step at a time and repay your debt in the way that makes the most sense for you.

While repairing your credit won’t initially get rid of your debt.

Eliminating negative items like collections and charge-offs and raising your credit score will help you to get new credit lines which can help you to transfer high debt balances to lower interest rate cards and loans which in turn will help you reduce and eliminate your debt.

You can repair your credit on your own or you can hire a service. We have reviewed and selected the top credit repair companies. Sky Blue Credit Repair is our #1 pick. They offer a 90-day money-back guarantee.

Having a better credit score will save you a ton of money in interest rates. Here are 19 benefits f having a good credit score.

Sky Blue Credit Repair can work on repairing your credit while you work on getting out of debt

Here Are Some Cool Ideas on How to Save Money

Saving money can be and very strong way to leverage paying off your existing debt. If you are creative, you can start to pay down your debt while saving at the same time.

21. The 10% Rule – A sure-fire way to save even if you are in heavy debt!

This proven technique can be primarily found in the book, The Richest Man in Babylon. The idea is to put away 10% of all of the money that you ever receive. Example: If your paycheck was $525 take home, you should take $52.50 right off the top and put it into another account. You can call it your “Babylon Account”. You would then be left with $472.50 net. The philosophy is that you have to make believe that you only made the $472.50 and you CANNOT touch the 10% you took out unless you are investing it. Many people think that they need the entire $525 but this simply is not true. The fact is that you will survive no matter what.

If you were given $20 and you took out $2 (which is 10%) do you not think that you can make the $18 go just as far as the $20? Be creative and you will be sure to save money and get out of debt using this simple rule.

If you follow the 10% rule religiously, you will see your Babylon savings grow substantially over time. It is very exciting to actually be able to save with this simple 10% rule. Trust us, if you follow the technique, it will work.

22. Make a simple budget

This is very simple; you should first write down all of your spending.

You can do this in a notebook or in a memo app on your phone. The key is to write down every single penny that you spend each day for at least a week. This will help you become more aware of your spending. It can also begin to help you categorize your spending and identify areas that you can cut. You can do it in a budgeting app if you have never tracked your spending before.

You should write down all of your expenses and it should look something like this:

Monthly income: $4,000

Expenses

Rent/mortgage: $800

Household bills (utilities/electric/cable): $450

Credit card bills: $600

Groceries: $300

Dining out: $225

Gas: $100

Emergency medical: $200

Discretionary: $600

Entertainment: $300

Car / Fuel: $200

Misc: $400

Investments: $225

Total Above = $4,400

When you see your expenses on paper, it gives you a good overall picture of when and where you can cut spending.

In this example above, you are spending slightly more than you are taking in, and you are ultimately going into more debt.

By doing this, you can have a better picture of where you can be cutting back. In this scenario, I would try to pay off my highest balance credit card as quickly as I could and get the credit card bills monthly payment lowered. I would also concentrate on cutting back on dining out, discretionary expenses, miscellaneous expenses, and entertainment.

For help with creating a budget, use the following website to see a sample list of expenses. Here are some budget tips and tricks.

23. Plan first / decide later

If you want to buy something that is a large expense, do not make impulse buys. You need to do a lot of market research. You need to narrow down your choices systematically. You should also first save your money, so you have buying power.

For Example: If you want to buy a car,

First, you should make sure that you have saved money for it.

Look for the best affordable cars within your budget.

Narrow down your choices to which car and model you want.

Perform a market study and read reviews.

Shop a few different places that have your model. Never buy on impulse.

Agree to the best terms and pricing that you can get.

24. Seek out free products

Make a fun game at home where every family member has to try to find the most free stuff over a 30-day period. There are many websites that offer free and valuable products and/or services.

Always search the internet for a free trial of a product that you use often. You can email companies and ask for a free trial of their product or service. You would be surprised and how many companies will send them to you.

There are many cool websites that are marketing just for free stuff!

When you’re trying to save money to help you pay down your debt, free is the best price of all. Take advantage of free items and activities whenever you can. You will be amazed at how much you can get for free.

Most fitness centers offer your first training session or class for free.

If there is a beauty school nearby, a single phone call will often get you a haircut (and in some cases a style, shampoo, and even color) for free. Yes, you’ll be dealing with a student, but they’ll be supervised and more than willing to volunteer their services in order to gain real experience.

Most communities and colleges offer a number of activities for free, including concerts, plays, and even art shows. Getting out and having fun doesn’t have to cost money. Even if there aren’t these types of activities in your area, getting out into nature is an excellent way to unwind, and nature is always free.

One of the best ways to get daily-use items for free is by joining any one of the websites that helps you receive free samples in your mailbox every day. Just search for free samples on Google.

There are many websites where you can sign up to receive free magazine subscriptions, vitamins, over-the-counter medications, even pet care, and other products, all for free. You can’t beat free!

25. Eliminate excessiveness

There is an old quote “the excess of everything is bad”

Try to buy only those things which are necessary for your daily use. Avoid buying more than you need on impulse. Eliminate all the little extras that you don’t really need. Don’t eat or drink excessively because they both cost money.

Here’s a very sound strategy to get out of debt (and save money) | The #1 Way to Get out of Debt and Build Wealth in Just 2 to 5 Years!

Get out of debt with the Money Max Account

The Money Max Account is an astonishing debt payoff planner, tracker, and debt elimination software that was created by the owners of United Financial Freedom and it really works!

Here is how the Money Max Account Works

All you have to do is plug in your financial information which would include a list of your credit cards, the amount owed on the credit cards, the interest rate of those credit cards, and the due dates of those credit cards.

You will also add in the information for any loans and mortgages as well as other living expenses including telephone bills, car payments etc.

A Money Max Account agent will even do it for your help you to do it.

Then the software tells you exactly what to pay and how much to pay on it.

It will show you how to eliminate ALL of your debt, including your mortgage and your car within 2 to 5 years.

Ways to Save Money at Home

27. Set cost-effective meals

Before anything at all, please know that there’s no compromise when we’re talking about health. However, you should also know that spending a decent amount of money on outside food is also not always a prudent option. Check out what’s on sale in your favorite grocery shop and set your meals likewise. A weekly meal plan could do the trick. This weekly plan would assist in holding you from impulse buying. Remember, eating out is a huge budget-buster. If planning and setting meals stops one last-minute call for a pizza home delivery, you’ll save no less than $20.

28. Stretch what you already have

Why not add a little water to your jug of OJ? Or why not add a little water to your Windex bottle occasionally. Certain things are unaffected when diluted. Be creative.

—-> Dilute your shampoo! Yeah, Baby! Oh, Behave!

—-> Dilute Your Laundry Detergent

—-> Cut your toothpaste tube when you cannot squeeze any more out and get at least 2 or 3 more brushes!

—-> Use a DIY bidet to save toilet paper. Keep that roll of toilet paper much fatter by rinsing instead of wiping. Yeah, Baby! Oh, Behave!

29. Save water while dishwashing

Spray a little amount of water on the dishes in the sink and turn it off while scrubbing. When it becomes time for rinsing the dishes, turn on the water again. Hand washing instead of using a dishwasher and turning off the water while scrubbing can save 200-500 gallons of hot water each month! Now that’s something beneficial for the environment and for your pockets as well.

30. Research

If you need a new appliance or something similar, don’t just dash to the store and buy one. Research is the real deal! You can search for the same thing online and save a lot of money by doing so. Purchasing online often means buying something at a lower price than that of any tangible store. Hence, it is extremely essential that you carry out thorough research using the internet, and know which place offers you the best rates, especially when making a big purchase. Make the best use of the price comparison.

31. Unplug

Even when they’re turned off, many small appliances continue to use electricity for as long as they’re plugged in. This includes your microwave, coffee maker, television, and even your computer and laptop. When you’re not using these items, unplug them from the wall, or have them connected to a surge protector that you can turn off. You will be surprised at the amount of money that you’ll save on your electric bill each month.

Another great way save on electric costs is by avoiding using electricity whenever possible. Turn off the lights, television, and computer whenever you leave the room. Place a clothesline on your back porch or in the yard and hang your clothes out to dry – not only will you save on your electric bill, but your clothes will smell great and last longer, too! Additionally, invest in some cold-water detergent and wash your clothes in cold water. Believe it or not, heating the water to run the hot or warm cycle is one of the most expensive parts of washing your clothes.

32. Cook More

Rather than buying premade microwaveable food, or eating out every single night, you can spend less on ingredients and make a delicious meal at home. Cooking can also be a fun activity to do with a loved one or your children. Not only will you be making new and tasty meals for half the price, but you will also be making memories with your significant other and children.

33. Do your own baking

Being your own baker is a wise decision to take for saving money. Let it be sweetbreads, cookies or cakes—bake it yourself. You could involve children in the work, and the joy would increase by a hundredfold. Moreover, you could save big if you make it a habit to purchase sugar, flour, and other ingredients on sale. A 13×9 inch cake sells for something around fifteen to twenty dollars while you can very well bake one for less than two dollars.

34. Use baking soda

Instead of buying an expensive tube of toothpaste, use baking soda instead. If you mix it with a little bit of water, it can whiten and clean your teeth just as well as toothpaste. Baking soda can also be less harsh on your teeth, saving you money on dental bills later in the year.

35. Host a potluck

If you are hosting a party for the holidays, make it a potluck. Coordinate with your guests and have each person bring a different item. You will only have to pay for the ingredients you cook, your family and friends will have fun and think this is simply a cool idea. You never know, they could also leave the leftovers behind! You may be able to get 2 or 3 meals out of the leftovers.

36. Use a water filter

If you drink a lot of water, stop buying cases of bottled water. Invest in a Brita filter or Brita water bottle and save hundreds of dollars on water each year. You’ll also be helping the environment too!

37. Control your cell phone and cable expenditures

Look at the number of minutes and data that you use each month and call your providers to see if you can cut back on the plan. You do not want to pay overages, but you may be able to cut back a step or two to save money on your cell. Consider how much you watch television and the shows and channels you need. You may be able to make it on basic cable or without it all together. Netflix and Hulu combined are much cheaper than any cable bill you may have.

Ways to Save Money by Being Crafty

38. Make your own gift items

There are many gift ideas you can create yourself rather than visiting a store. Let’s say a birthday is coming up. An average birthday card could cost around $6 from a gift shop. However, it’s highly likely that the card will be tossed by the recipient sooner or later. Therefore, get creative and be the craftsman. Make a birthday card yourself with your creativity. Such gifts are far more worthy because they contain warmth and time spent for a loved one.

39. Make other things on your own

Some things are cheaper if you make them on your own. One such idea is to make your own spaghetti sauce. If you use canned tomatoes and make a sauce, you can save up to $3 to $5 compared to buying a jar of sauce. Making pickles is also very cheap compared to buying premade jar pickles. You could also make candles, homemade dog food, homemade deodorant, homemade mouthwash, and more.

40. Focus on self-sufficiency

Whenever possible, be self-sufficient. Even those of you who live in the city can grow a few simple vegetables and herbs in a pot on your porch or balcony. Learn how to cook quick and healthy food items instead of eating out. Buy fresh vegetables in bulk when they’re in season and learn how to make and can your own sauces. You will be amazed at how much these simple steps toward self-sufficiency can save you.

One of the ways where you can really become self-sufficient is by learning how to make your own detergent and cleaning products. Homemade shampoo, detergent, and dish soap work just as well (and in some cases better) as store-bought brands but will cost you pennies in comparison. Though it will take some effort on your part, it is well worth the money you’ll save in the end.

Ways to Save Money by Being Thrifty

41. Swap stuff

An amusing way of not spending more on items such as clothes is swapping your items with someone else. Let’s say you have unused clothing or clothing you don’t want to wear anymore. Instead of buying more clothes, why don’t you invite and meet all the other people who are in the same boat as you? Organize a swap meeting with a group of friends and tell them to bring their unused or no-longer-wanted items. Then trade, swap, or barter—do whatever you want amongst your friends. You shall benefit because of new-to-you items. The same process could be done online, as well if you search for swapping sites.

42. Shop thrifty

Buying new clothes, household goods, entertainment, and even things like small appliances and furniture doesn’t have to be expensive, especially if you’re willing to buy used. Today’s thrift shops carry a wide range of items for sale, most of which are only very gently used. I’ve been buying clothes and other items from thrift stores for years with no one the wiser. Often you can even find high-end name-brand items for sale at your local Goodwill and Salvation Army thrift stores if you’re willing to put the effort into looking.

As an added bonus, shopping at these locations gives you the satisfaction of helping someone who is in a worse situation than you. The Salvation Army and Goodwill thrift stores are completely non-profit, with all of the money these stores make going back into programs that help the homeless and disabled find housing and employment. You’ll save money on your regular expenses (allowing you to put more of your income into paying off your debt) and help someone else at the same time.

43. Start couponing

For those items that you can’t live without or buy used, coupons can save you hundreds on your costs each month. There are dozens of couponing sites out there, many of which will help teach you how to join the “extreme couponing” crowd. If you’re willing to put the time and effort into it, coupons can reduce your monthly grocery bills to almost nothing – in fact, there are many extreme couponers who can get hundreds of dollars worth of food and personal care products for free!

One of the most popular sites to get free printable coupons is Coupons.com.

Buy coupons

One way to get started is by taking advantage of websites that sell coupons in bulk. If you know that you absolutely must buy a particular brand of cereal or shampoo, scour these websites for coupons on those items that will allow you to purchase them for only pennies. The expense you pay for the coupons will usually be far less than the cost of the item, leaving you with more money in your pocket at the end of the day.

One such site that allows you to do this is Klip2save.com.

Did you know that you can also buy awesome coupons from eBay? They have pre-cut coupons in almost any market. They almost always have 10% off of Home Depot coupons, so if you needed to buy an emergency oven for $500, the extra $50 off would help. There are also many eBay users who pre-cut grocery coupons and charge only $1 for 100 pre-cut coupons.

There are many websites that sell pre-cut coupons as well. These are great because you can buy multiples of products that you use often. You don’t have to go crazy, but you can certainly save anywhere from 20% to 80% of your grocery bills each week.

Also, make sure to search online for coupons of things that you use often. If you drink V8 every day, search for V8 coupons. You can usually find many coupons directly from the manufacturer.

44. Return used / unneeded stuff

Many items offer a 60–90-day return policy. Therefore, if you have anything lying around the house which you bought recently, you can return it with the receipt. This would prove more advantageous if you’ve made a big purchase recently and are in need of more money rather than the item itself.

45. Eat smarter

Did you know that you could live off of spaghetti and/or rice and beans for a couple of weeks? Spaghetti is almost always on sale and you can feed a family of 4 for less than two dollars. Be creative and come up with awesome variations of the sauces and the way you serve your meals. Better yet, create a cookbook while doing it with photos and you can sell the book for millions of dollars in the end. :) You can name it “How to Survive on Spaghetti for a Year”.

46. Use what you have

Whenever possible, make do with what you have and avoid spending at all. Just because the newest model of your favorite smartphone or computer just came out doesn’t mean you have to rush out and buy one, especially if your current model still works fine. The same goes for larger ticket items such as televisions, appliances, and vehicles. It may be nice to dream about having all of the latest up-to-date items, but if what you have is working fine, why spend the money just to have something new?

The same goes for smaller items like clothing and shoes. Do you really need another polo shirt just because it’s an interesting color when your closet is already full? Do you have to buy that video game the day it comes out, or can you wait a month and buy a used copy at half the price? Even better, why not pull out one of the games you already have but haven’t finished yet? Whenever possible, make do with the things that you have. Remember: it’s for a good cause – helping you pay off loans and credit cards so that you can begin living a debt-free life.

47. Recycle baby!

Although recycling may not seem like a money-making method, it can be. Some companies will give you money in return for recycled bottles and cans. Research the recycling centers in your area and find out where you can get repaid for that can of soda you drank at lunch.

48. Buy in bulk

While it may seem economically savvy to buy smaller portions when you are trying to save a few dollars, you can actually save money by buying more. If you shop at stores such as Sam’s Club, BJ’s or Costco, you can buy many of the name brand items you love, in large quantities, for less money. This is one alternative you have if you do not want to buy generically branded items.

49. Share

This can be a great way to save money. Whether you are sharing an apartment, car or even just a meal at a restaurant, the bill will be cut in half, saving not only you but also the person you are sharing with, money. Maybe you can share with another friend or family member who is looking to save money; the two of you can share in your journey towards a debt-free life!

50. Shop in a hurry

According to the Mother Nature Network, the average American spends around 8% of their income on groceries. And with all the tactics of marketing and impulse buying, grocery stores are also trying to find the best ways to woo customers into purchasing more.

A simple, yet effective trick you could use is to shop hastily. Let’s say you have an appointment in thirty minutes or have to pick up the kids from school. Then you’ll have to finish your shopping at a fast pace. Grab a stopwatch, shop only for what’s on your list, and you’ll see that you’re holding to your budget!

51. Cut your transportation costs

If you live in the city, cutting down on transportation costs is easy. Walk, bike, and use public transportation whenever possible. With gas now $4 per gallon across the United States (and much higher in other areas), the amount of money you can save by leaving the car at home may surprise you. If you do need to use a car, try to carpool whenever possible.

For those of you who live in rural areas and must commute every day, there are a number of things you can do to save on your gas mileage. First, make sure that your vehicle is properly maintained. Check and change your oil whenever appropriate and ensure that your tires are properly inflated. Then, empty your car of everything you don’t need – the extra weight can increase your gas mileage.

If you’re traveling by plane, have someone drive you to the airport and pick you up instead of paying to park your car. Take advantage of online deals from sites like Hotwire in order to pay the lowest airfare possible. Finally, avoid baggage fees by packing light. Try to fit everything into a small suitcase you can use as a carry-on. You can also try to travel at off-peak times in order to minimize your costs.

Automobile Related

52. Drive more economically

Drive slower and keep at moderate speeds to avoid wasting gas. Don’t use the air conditioning unless 100% necessary and avoid long drives. Make sure to price shop the pumps and use regular if you were using higher grades of gas. If you’re conscience, you could save $20 or more a month by driving more economically.

53. Carpool

If you carpool with a coworker who lives close to you, the two of you will save on gas money, tolls and distance, while still getting to work on time. Additionally, carpooling will give you the chance to get to know your coworker better, in a less stressful atmosphere.

54. Check your tire pressure

Check your tire pressure – Keeping your tire pressure at the correct level will keep you from wearing your tires out quickly, thus saving you the cost of buying all new tires.

55. Buy cheaper gas

Just like every other item you buy, you should price shop your gas, purchasing from the station that offers it the cheapest. Additionally, you should always try to buy regular fuel if your vehicle allows it. Regular is always the cheapest and there is no need to buy premium if your car doesn’t require it for proper function.

56. Buy leftover cars at the end of the year

Buy leftover cars at the end of the year – This may sound strange, but if you are in the market for a new car and you do not want to buy used, consider waiting until the new year’s models are released and buy a leftover car from the previous season. These cars are still new, just last year’s model.

57. Wash your own car

This is also a great way to get some exercise and fresh air.

More (Thrifty) Best Ways to Get out of Debt

58. Live tiny

There is a new grassroots movement that has been gaining momentum across the United States that allows individuals, couples, and even families to cut their living expenses and achieve financial independence. While it’s not for everyone, the Tiny House Movement involves cutting costs by downsizing your living space. Houses in the United States are nearly twice the size of houses in the rest of the world. Members of the Tiny House Movement aim to live in a house that is half the size of the average American home – which means living in 1,000 square feet or less.

This may seem like a drastic step to take, but it has a number of advantages. Because they are so small, many tiny homes are built on trailers that can easily be hooked to your vehicle and moved, much like a camper or RV (in fact, some people use a pull-behind travel trailer as a tiny home). This frees you up to travel and allows you to live on a smaller lot than you would otherwise. Additionally, a prefab tiny home costs around the same as a high-quality car – about $30,000.

59. Use your mobile operators and special plans

Mobile phone companies are often seen to encourage the combining of family members, and they offer substantial discounts as an incentive. Therefore, it would be great if you extend your family tree and include your grandparents, uncles and aunts, grandchildren, and all the other family members on your plan. As a bonus, this method is cost-effective for everyone inside the family.

60. Don’t collect

Trim the fat of duplicates. Many people collect something. Are you collecting something because it is a hobby? Do you really need to collect that particular item? If the answer to the second question is “no”, consider bringing your collection to a pawn shop. You may be able to get a decent amount of money for the item you were simply keeping in a drawer.

61. Cut down on expensive hobbies

Hobbies like golfing, skydiving, gambling, skiing, shopping, gaming, antiques, and traveling can really put a dent in your wallet. Cutting back on hobbies and using that money to pay down a high-interest rate credit card will surely help you to get out of debt.

62. Services from those who are training

Our human needs do not take a break when we are in debt. If you need a haircut, massage, or a cavity filled, why not contact trainees who are working to become professionals. You can communicate with the local dentistry school and inquire about any dental problems. It’s a win-win deal for both ends because you’ll get treatment at a fraction of the cost compared to that of a professional while the trainee would get their craved for experience. But do remember that you’re dealing with your health. In most cases, you’ll get what you pay for.

63. Use reward programs

Use reward credit cards if you can. Cashback reward cards are great because you get the items you want, plus a portion of the cost in return. Also, look for items you need that are on sale with a rebate. Like the cashback rewards, you will get a portion of the cost back, simply by mailing in a piece of the receipt.

64. Partake in less expensive or free activities

Many organizations and companies host free events that aren’t boring. Search Google for events in your town or county and find a handful of free activities, or cheap events, that are coming up. Whether the event be a concert, festival, art show or workshop, you will have a good time, and keep some money in your pocket.

65. Buy a small house

The cost of owning a house can really weigh you down. From electric and utilities to gas and water, you are spending countless dollars each month on your home. If you have a mortgage, that can also add unneeded weight to your shoulders that you do not need. By purchasing a smaller home, you will spend less money on utilities and, maybe best of all, you may not need a mortgage. A smaller home could cut your spending in half, if not more and, while you may initially miss the extra living space, you will adjust to smaller quarters.

66. Use the library

Some libraries have free movies and CDs for rent, as well as free computer access. Also, don’t forget what the library is really for…books! You can find books on any topic and rent them for free. Books can transport your mind anywhere in the world, allowing you to go on a journey with the characters you are reading about. All you need in order to gain access to these books is a library card and signing up for one is free and only takes about 5 minutes. You can also rent do-it-yourself books to learn how to do your own repairs instead of paying handymen.

67. Cut efficiency costs

Air seal your home. Turn down your thermostat a tad in the summer. If available, have your air conditioner shut off about 2 hours after you fall asleep. Lower your fridge a little bit. These methods may seem pointless, but you actually spend a lot on air conditioning and heat so shutting them off for a few hours each day can certainly save you a pretty penny.

68. Cut down on vacation spending

Of course, everyone deserves a vacation, but the added cost of adventures, high-end hotels, and eating out every night can be costly. Rather than eliminating the vacation entirely, which is another option, consider staying in a 3- or 4-star hotel instead of a 5-star, only visiting the sites and attractions that are most important to you and limiting yourself to restaurants with an affordable menu. Sure, there will be some expensive places that you want to visit, but if you get out of debt and plan a second visit, spending time at these places may be more rewarding.

69. Lower your insurance

Shop for cheaper car insurance or health insurance. Reevaluate your plan and figure out if there is a way that your monthly cost can be lowered. Also, telling your insurance company that you are leaving for cheaper rates may entice them to give you a better deal.

70. Drop (Stop) your subscriptions

Do you actually read all of the magazines that you have subscriptions for? Is there a cheaper alternative such as reading them online? If you are getting about 10 magazines delivered to your house each month but you only read 2 of them. Cancel the subscriptions to the ones you do not read. Also, although you will still have a subscription fee for online magazine issues, it may be cheaper and worth the consideration.

71. Shop for cheaper life insurance or for a policy that makes more sense

If your life insurance policy is packaged in such a way that you are spending more than necessary, think about changing your plan. Remember, your family will only need enough to cover the cost of your expenses, so a large package may not be financially worthwhile. Also, if you get to a more financially sound state and feel that your family deserves more, you can always change your plan again.

72. Price Shop

Did you know that you can get AA batteries in bulk on eBay way cheaper than in your local drug store? Before making any purchase, big or small, it may benefit you to shop around and see which store or online vendor offers it for the lowest price.

73. Buy Generic

When shopping, compare a less expensive, generic product that can save you money. Buying less expensive everyday products can open up some liquid capital quickly and easily. To control your finances, you must keep in mind that you should always be comparatively shopping. Many items like paper plates are much cheaper when buying generic. Buying generic medicine also saves big. While there may be certain things, such as makeup or a specific brand of food, that you do not want to buy in the store brand, it won’t matter if your paper towels are Bounty or a generic store brand.

Check your tire pressure – Keeping your tire pressure at the correct level will keep you from wearing your tires out quickly, thus saving you the cost of buying all new tires.

74. Buy used

Everything you buy doesn’t have to be new. While you won’t want to buy everything used, purchasing a car used shouldn’t pose a problem, especially if you look for a CarFax report. Other items that could be OK if purchased used include clothing (Goodwill stores and thrift shops), computers, phones, or books.

75. Cut back on entertainment

Who needs to go to the movies anymore anyway?

76. Stay in rather than going out

Cook meals at home instead of eating out. It can be cheaper and more fun!

77. Avoid free spenders

If you have friends who spend their money freely, spend less time with them or do free things with them, while trying to pay back debt.

78. Do not let others hurt your efforts

If your friends think paying back your debt has made you less “fun,” remind yourself that you are doing something smart!

79. Find cheaper stores

If you live in an area with multiple convenience stores, go to the one that typically has better prices.

80. Start a vegetable garden

This is a great way to get good, wholesome ingredients at the fraction of the cost of store-bought produce. An even better fact about home-grown vegetables is that you control what is used to help them grow. If you don’t want pesticides to be on your food, you won’t use them!

81. Don’t impulse buy when shopping

Many stores have kiosks upfront that tempt you to buy magazines, candy, or lip gloss at the very last minute. Don’t do it. Also, always consider whether or not you need an item before handing over the cash. If you can live without the item, even for a few weeks, hold off on buying it.

82. Cut back on entertainment costs

As we said previously, you may enjoy all of your entertainment activities, but they are costly and unnecessary. Do not cut them out entirely, but maybe you can attend one concert a year instead of three.

83. Only buy sale items

If chicken is on sale at your local grocery store, eat chicken. Buy smart and use the sales as inspiration for your meals each week. Find awesome recipes for free online and use as many sale items as possible.

84. Buy the day after a holiday

Thanksgiving isn’t the only holiday with huge sales following its completion. Look at the flyers, listen to the radio in the car, and see what’s going to be on sale around the holiday.

85. Pack lunch

This is a cost-efficient way to have a good meal and not spend extra money. If you made a delicious dinner the night before and you have leftovers, pack them up and eat them the next day. This can also stop you from wasting food and essentially throwing money away.

86. Save your change

Loose change can really add up. Take all of the change out of your pockets at the end of the day and place it in a jar. At the end of the month, count the change and see how much you unknowingly saved!

87. Do the dollar bill challenge

Whenever you get home, take all your loose $1 bills, and put them in a jar. This will keep you from spending them and believe it or not, you will save money this way as they will add up. Make sure to start another jar to collect loose change. Give that loose change a goal. Like maybe use it to pay off a certain credit card.

88. Automatic deductions

Have your payroll company deduct some money from your check each pay period. If it is automatically deducted, you won’t miss it and the money will be saved.

89. Avoid using ATMs with Fees

ATMs are great because you can get cash fast, but not all are partnered with your bank. To avoid a $5 fee for a $20 extraction of cash, check with your bank and see where you can use an ATM for free.

90. Use doctors in your network

If you need to go to a doctor, choose one who is within your insurance network. The cost per visit will be significantly less than if you go to an out-of-network doctor.

91. Research low-cost pet treatment or Use the town’s “free shots for pets” day

Getting a cat or dog neutered can be expensive, but if you buy a low-cost certificate for the surgery through Friends of Animals, you will save around $200. Google the foundation for a list of participating vets so you can ensure you get the savings. Or if you have a cat or dog, do not pay for a shot at the vet’s office. Instead, wait until your town offers to administer the shots for free. Your pet will still get the injection they need, and you won’t have to pay a dime.

92. Buy clearance items

Clearance items are like sales doubled. These items are often going out of season (holiday decorations) or surplus items that the store is trying to get off the shelf, but there is nothing wrong with them. You can sometimes find just the thing you need on a clearance rack.

93. Don’t pay for a gym membership

You don’t need to go to a gym in order to run on a treadmill, there is plenty of room outdoors where you can run. The same can be said for abs and weights. Do some crunches on the floor and put some cans in a bag so you can use them for weight training.

94. Sponsor or share events

Events might sound like a nightmare during times when you are struggling with debt. However, the tables will turn if you simply look for sponsors. “This wedding is brought to you by McDonald’s” might sound a bit out-of-the-box, but a strange truth is that many couples have had their weddings sponsored. Dave Kerpen and Carrie Fisher, a wise couple, got 25 sponsors for their plush wedding ceremony, and they received $100,000! Why not advertise some logos in return of memories worth cherishing? On the other side of the coin, you could very well share an event with another person celebrating the same occasion. That would help a great deal in reducing costs.

95. Use rechargeable batteries

While you will use a little more electricity, the rechargeable batteries will save you the cost of buying a new package of batteries every few months.

96. Replace your shower head

Many shower heads will dispense more water than necessary for the average shower. To avoid wasting water, replace your shower head with a water-efficient one.

97. Bundle electronics

Many phone companies will allow you to bundle your phone, internet and TV, saving you huge amounts of money and the hassle of multiple contracts.

98. Bundle insurance

If you bundle your car and home insurance, you can save a good deal of money. In some instances, your savings could be upwards of 17%.

99. Do not pay for photo prints

Print your photos at home or store them on your computer rather than having them printed at a kiosk.

100. Use things completely

If you are a student and you use highlighters, don’t throw them away until they won’t dispense any more ink. The same can be said for cooking. This style of cooking is called nose-to-tail cooking and whether you apply the method to food or pens, the concept is the same: if you use a product entirely, you’ve gotten your money’s worth and saved on overspending or throwing money away.

101. Wear your glasses

Contacts can be expensive so you may want to wear your glasses instead. Yes, you may be accustomed to your glasses-free look but wearing your glasses could give you an entirely different look that your friends will love. Best of all, you’ll be saving a minimum of $40 per month.

102. Use gift cards

If you know you really want something expensive such as a new TV, don’t spend your money on it. Instead, ask everyone you exchange gifts with for the holidays to give you a gift card to the store that sells the item. If each person gives you a portion of the cost, you may be able to make the purchase without spending a penny of your own earnings.

103. Get rid of unused parking passes

Having a parking pass for a park and ride could be a financially smart move… if you use it every day. If you only use your parking pass once a week or so, get rid of it and pay for daily parking. You will save a great deal of money doing this.

104. Get rid of your P.O. box

If you live in the suburbs and you have a P.O. Box, get rid of it. Paying the fee for a P.O. Box if you can have a mailbox on your property is not worthwhile. Cutting this cost out of your monthly or yearly budget will take some of the financial strain off your shoulders.

105. Reuse items

Similar to recycling, reuse your items for yourself. Newspaper can be a good wrapping paper for presents, book cover for textbooks or used to clean windows instead of paper towels. Plastic bags can be a great make-shift garbage bag. Cut the bottom off a plastic bottle and use it as a funnel, perfect for putting fluids in your car.

106. Barter

Join a local barter system and trade your services for other services you need. Depending on the area you live in and the system in your area, you might not need to exchange one for one. Instead, you could give your massage services and earn credits to buy something you need at a later date.

How to Save money by making lifestyle changes

107. Quit smoking

If you smoke, quit. Smokers have heard the term ‘quit smoking’ a thousand times, but many often fail to find the motivation required. Here’s good news coming your way. Let’s say you smoke two packs per day with each pack costing eight dollars. Utility bills will come in the form of greeting cards since you’ll have an extra $112 per week in your pockets. That means an astounding saving of $448 a month! How many bills could you pay with that? And all you got to do is get rid of the nicotine sticks! How’s that for motivation? How many bills could you pay with that?!

108. Avoid bad habits

Bad habits not only affect our budget but they can also harm our social, physical, and psychological condition. Bad habits can include smoking, drinking, shopping, and excessive eating during the nighttime. All of these can hurt the pocketbook!

109. Drink less expensive beer / Wine

Stop being spoiled by IPAs, Heineken, and Grey Goose and save up to 50% with more economical brands. Better yet, quit drinking!

110. Stop going out for coffee

The average cup of coffee at Starbucks is around four dollars. So if you go out for coffee twice a day, you are looking at just about $3000 per year. Add in a pastry or a breakfast sandwich you are busting over the 4K mark.

111. Don’t go out to eat as much

Let’s say you go out to eat somewhere around six times a month, and the average bill is something around $60; if you simply cut that to three times a month, you could save $180 each month! Two credit card payments can then easily be dealt with!

112. Make your health a priority

Believe it or not, paying your copay each year and going to regular checkups could cost you less than waiting until you are truly ill. If you wait until something is seriously wrong, you may end up hospitalized and hospital stays are far from cheap. Spending the few bucks now could potentially save you thousands later.

Here Are Some Cool Ideas on How to Make Money

113. Clinch a second job

One of the fastest ways to show the debts who’s the boss is to take up a second job. This could be done in many colors. You could become a referee, a virtual assistant, or even a lawn maintenance guy!

114. Start your own side hustle working from home

You could sell your talent in online marketplaces such as Odesk and Elance. Fiverr.com is also a great online marketplace where you can sell your expertise for additional income. At Fiverr, people advertise what they have to offer for five dollars. You could earn five dollars by writing, doing a voice-over, and so much more! Moreover, if you’re not interested to take up a second job, opt for working overtime if available. Here are some super creative ways to make money online.

115. Start your own business

You can start a business with very little or no money. Here are 50+ amazing business ideas of businesses you can start right away!

How about starting a credit repair business? You can help others and get a 6-figure business off of the ground with very little start-up capital. See our free step-by-step guide on how to start a credit repair business from your home. With some extra income, you’ll be able to get your debt in check quicker!

116. Affiliate marketing

You can start making money right away without having your own products or services with affiliate marketing. Here is a good blog post on how to go about getting started with affiliate marketing.

117. Start a Blog

Blogs are extremely popular. People read them on a regular basis, If your blog is popular enough, companies may choose to advertise on your page. You could charge a reasonable amount for each ad and walk away with a few hundred dollars. You can also be an affiliate and sell other people’s products! The best part? Starting a blog is free and you will be writing about something you love. Learn step by step how to start a profitable blog.

118. Sell things around your house

You can try out Craigslist, Facebook Marketplace, Letgo, or other platforms to sell the items lying around your house that you don’t really need anymore. You might be surprised by the money you make. For example, we saw a person that had 25 plastic storage tubs on Craigslist that sold for 75 dollars!

Other resources for selling unwanted items are local flea markets, Amazon, eBay, Bonanza, Poshmark, Ruby Lane, Etsy, and Swappa.

119. Click to Earn

One of the easiest ways to earn a little extra money online is by joining a site that lets you watch or view ads, complete simple activities, and answer surveys in exchange for points. These points can later be exchanged for gift cards at your favorite restaurants or stores and in some cases may even be traded for cash. The great thing about these sites is that they pay you for doing things that you would already be doing online anyway.

One of my favorite sites for this is Swagbucks. By entering a few codes (released on their social media accounts each day) you can earn points which can be exchanged for gift cards, or for cash deposited directly into your PayPal account. You can also earn points by playing games, watching videos, and even by printing and then using coupons. The site even has an online shopping portal where buying things at the stores you would normally visit anyway earns you points. This is one of the easiest ways to earn a little extra cash. Signing up is quick and free – if you have a Facebook account, all you have to do is click a button.

120. Become a handyman

If you have a knack with your hands, become your own handyman in your area and fix any small problems that you can to make a few extra bucks.

121. Use your talents to your advantage

If you have a skill or a talent such as cooking, weightlifting, or writing, enter a competition with a cash prize. You may have doubts about your own skill, but you might as well give the competition a shot. You never know who you are competing against; chances could be in your favor!

120. Patent an idea – If you have created something unique for your own use, something that is not on the market, try getting a patent for it and selling it. People around the world may have a need or want for your item and by patenting it, you will get a portion of the sales!

122. Patent an idea

If you have created something unique for your own use, something that is not on the market, try getting a patent for it and selling it. People around the world may have a need or want for your item and by patenting it, you will get a portion of the sales!

Here is an Ironic Way to Reduce Debt and Make Money: Get out of debt by helping people to get out of debt

123. Start a Debt elimination affiliate business!

Hey you’re in debt, right? How ironic would it be if you started your very own debt elimination business?

You will get paid between $500 to $1,500 per client for simply sharing an award-winning Debt Elimination Program.

Other ways to make money

124. Have a yard sale

Having a yard sale is a great way to free yourself of clutter and get rid of some of the items you don’t need. While you may not make a lot of money off of each individual item, those pennies and dimes can add up. At the end of the day, you could walk away with a couple of hundred dollars.

125. Use your car for advertising

Take advantage of inexpensive cheap door-magnet advertising. Magnet advertising makes it inexpensive and cost-effective for domestic businesses to advertise on cars. If you personally know someone who owns a local business, ask them if they’re willing to advertise on your car. This is a win-win method for both parties! This really is a great idea to pull a few dollars out of a magician’s hat quickly and easily.

126. Find the gold in your home

No, we’re not talking about surveying digging or prospecting on your property, but you might have money you don’t even know of right under your feet. It’s highly likely that you’ll find loose change hovering around the house. Moreover, you might also have the habit of saving using a piggy bank. Search for that money and save it in a jar because within a few months or a little more than a year, you will be amazed to find $201.94 dollars! Such activities assist a great deal in negating debts and encouraging savings.

127. Sell or rent space

You could rent out living space to someone with whom you’re well-acquainted. On the other side of the coin, you could actually sell your area. For example, if your house is near a big stadium or public entertainment venue, you could charge 20 dollars for parking in your venue during a big event. You can make anything between $50 to $400 just by renting a parking space if you live in a plush city.

128. Make unconventional income

Opting for unconventional income sources could be a prudent, amusing idea. For example, you could actually sell your hair! Yes, you read that correct. On eBay alone, there’s a huge section where you can sell your hair for a decent amount. Craftsmen use human hair for dolls while hair is also needed for weaves and extensions. You can also answer ads for product testing where you can make some additional income to pay down a credit card.

129. Become a host on Airbnb

You chose your price and availability for your guests and make money while doing it.

You are now prepared to battle with one of your worst enemies—debt.

Getting out of debt and gaining control of your financial situation can seem like a monumental task. It is important to remember that small steps taken consistently over time will help you to get out of debt quicker and can help you feel like you’re making progress, without having to sacrifice the important things in your life. While you will have to make some changes, those changes don’t have to feel quite so restrictive.

Here Are a Couple More Ways to Get Out Of Debt

Be careful with these options. They will work if done carefully and correctly.

130. Debt Consolidation Loan

Debt consolidation loans work brilliantly to consolidate all of your debt into one fixed monthly loan payment at a lower interest rate. But complications could arise if you are not heedful and you start to run up the credit cards that you have transferred the balances off of. In this scenario, you will start building up debt again.

131. Debt Settlement

Debt settlement is not our favorite choice to get out of debt, especially if you try to do it with a debt settlement company. The best way would be to negotiate a deal yourself directly with the creditor. If you can successfully negotiate your debts and pay lower debt amounts on each debt without it affecting your credit score, debt settlement is a decent option.

132. Bankruptcy

While filing for bankruptcy is known to be a very effective strategy to get out of debt while providing consumers with starting afresh life with a clean slate, it does have its drawbacks. See our in-depth guide on the pros and cons of filing for bankruptcy. Also, see how to get a bankruptcy removed from your credit report early.