How to Successfully Start a Credit Repair Business From Home | An Actionable Guide for Entrepreneurs

Do you want to work from home?

Are you considering starting a credit repair business?

If so, we have great news. You have just found the most definitive completely free guide to getting your business off the ground.

This is your foolproof strategic step-by-step actionable blueprint to success.

You can use this in-depth information in conjunction with the free online training from our partner Credit Repair Cloud.

It is going to take some planning, determination on your part, a lot of hard work, and most importantly a clear and concise roadmap on how to do it.

And you’ve just landed on your roadmap!

Our roadmap is filled with over 15 years of knowledge and experience in the industry. We promise to give you some amazing tips and tricks that you never knew about. And we’ll give it to you straight, The good, the bad and the ugly.

If you are going to have a successful business, you must make sure you are truly ready to dive into a credit repair business,

Let’s quickly try to assess that!

If you already know that you want to get started right away, or if you just want to see if it is something that you may be interested in, you can watch this free training video to immediately learn more right away.

Is a credit repair business really for you?

Do you have the right reasons to want to open a credit repair business?

If the answer is yes:

We are going to show you step by step exactly how to start a successful credit repair business in this guide.

Again, you want to make sure that this is the type of business that you really want to open.

Before we move on, let’s make sure if this is for you.

If you have any of the following reasons listed below for opening a credit repair business from home, then this is probably the right choice for you if you:

You already have some familiarity already with credit repair. Of course, if you want to get into the industry, you should have some understanding of how credit repair works. You should also be interested in the vertical as well. If not, you are definitely willing to learn. And if you want to learn, you may want to watch this free training class right now!

Doing hard work that truly means something is important to you. You get to work every day helping others to improve their financial lives. That makes for an amazing job. You will also be helping consumers with something that is their right by law.

You are ready to work from home and start your very own credit repair business. You want to create your own schedule and your own hours and you are tired of overworking yourself at your current job. When you start a credit repair business from home, you get to decide when you work and how long you work each day.

You want more flexibility in your life. Are you tired of missing family events because of work? When creating a credit repair business, this does not have to happen anymore.

You’re excited at the possibility of having unlimited growth potential. People all over the world need help to repair their credit and this will never change.

You no longer want to have to commute and you want to save money on renting an office.

You truly have a desire to help people and give back to the community.

You have some marketing experience or you have a desire to learn.

You’re not afraid of hard work and working long hours, in the beginning, to get your business off the ground.

These are just some of the many reasons why people decide they want to open a credit repair business.

If you fall under any of these categories, you are certainly a good candidate to become your own boss.

Or perhaps you have your own reasons and desires for starting this type of business. If so we’re glad you are here!

If you have the time, check out this free training video to see how you can jumpstart a successful credit repair business.

Let’s keep this real: Starting a credit repair business is a lot of work. Many individuals that do not go into this business with realistic expectations fail.

Many do not understand the initial investment involved or the time that they need to put into this business.

You will need to do a good amount of studying to become an expert in the field and you will need to learn how to market in a competitive landscape.

If you are willing to do that, you will succeed. Don’t worry, we will cover how to overcome any obstacles right here and right now in this training. If you follow along step-by-step, you can build a lifelong business that you will come to love.

Let’s dig into the awesome benefits:

What are the benefits of opening a credit repair business?

In addition to knowing what reasons you have for opening this type of business, it may also be helpful in your planning to know what benefits there are when operating a credit repair business.

Very profitable – A credit repair business can be very profitable. Check out this really cool credit repair business calculator that gives you a good benchmark to see an estimate of what you could be making and with how many clients.

Credit repair is recession-proof – Whether the economy is doing well or really bad, consumers will always need credit repair help. This will give your business the opportunity to have continued revenue. People all over the world continue to need help repairing their credit. This is not going to change.

It has a semi-recurring revenue business model – The average customer will stay in your credit report program for seven months. This gives you the ability to build up recurring revenue. You can be creative and offer a maintenance program after you have fixed their credit to keep the residual and lengthen the lifetime value of the client!

A credit repair business is scalable – Once you have your systems in place and you are using a good strong credit repair customer management software, you can start to grow your business and scale it. The processes do not change. You simply bring more clients on board.

You get to truly help people– It is a struggle to have financial issues. It causes stress, anxiety, and overwhelming feelings. By helping people to repair their credit, you can help to take these feelings away.

Self-growing business – Once you help someone, they are likely to refer you to other people in their life who need to repair their credit. While this is not to say that you won’t need to do any marketing, your business will basically grow on its own.

There is no ceiling on your earning potential – Once you get rolling you can start growing your business through a referral system as well as creating strong relationships with affiliate partners that will send endless leads to you.

Very inexpensive to start – It is relatively inexpensive to get out of the gate so can you start on a shoestring budget.

If you like the sounds of these benefits, it is time to start learning how to start building your credit repair business from home.

Step by step actionable tasks to starting and building your credit repair business

Now that you have made the decision to open up a credit repair business, it is time to carry out the tasks step-by-step to make this happen.

Having a business plan

We highly recommend starting with a business plan. Many companies are formed without much thought behind them. Your chances for success will be multiplied if you set up a good business plan.

There are a few options for going about this and there really is no right or wrong way to do this.

There are essentially two different types of business plans.

One option is a traditional business plan which is essentially very detailed

If you have the time to do it on your own, we recommend this option. We also recommend this option if you are considering getting funded by a lender either in your startup or at some point.

Here is some great simple information on business plans from the small business administration.

Here is a downloadable relatively simple sample business plan.

Another option is a lean startup business plan

Some variables for choosing this option may be that you have a good amount of experience already or perhaps you have run several businesses before and you have a strong understanding of credit repair. In this scenario, you can just simply write what we call a lean startup plan.

What your business plan should include

No matter which option you choose from above, here are some key factors that your credit repair business plan should include.

30 quick points of what your business plan should include

The more time that you spend on these points listed below before you get started, the more you will have a full understanding of what you want to get accomplished.

We highly suggest learning as many of these areas as possible.

It will set the foundation for you to get started on your journey.

Use spreadsheets and Word documents to help you get organized.

Know your end destination

If you set out on a boat, out at sea with no destination in mind, you never know where it will end up.

But if you have a clear vision of your destination, and you set out to sea knowing exactly where you want to go, your success rate will be multiplied by 1000% and you will surely be able to reach your end destination.

The more of these marketing points that you master, the higher your success rate will be.

If you are overwhelmed, take baby steps and start with just one thing. For example, start with the first tip listed above and

write down all of your reasons for getting started and what will make your service unique.

Getting a business name and entity formed

There are 2 parts to this, which some people get confused with.

We highly recommend that you create a business entity as an LLC or corporation, preferably an LLC for now, and then you can create a “doing business as” name underneath that.

You can name your LLC anything.

An example would be “Premier Holdings Group LLC”. Then you could make your business name whatever you want for your website. An example would be TheScoreBusters.com. TheScoreBusters.com would be an entity that you own underneath “Premier Holdings Group LLC”.

You can build other websites with different names as well, so you can have other entities under one roof.

Protect yourself

The company itself is its own entity and is not a part of your personal finances or assets.

If you don’t create an LLC and you run your business as a sole proprietor, any liabilities or anything that might go wrong would be on you personally.

It’s just not smart business because anything can go wrong and if it does, you do not want any liability.

There are literally dozens of places online to create an LLC.

We highly recommend choosing Inc Authority when creating an LLC or corporation for your business. They have a free service where the only thing you need to pay is the registration fee in your state. So its well worth it to use Inc Authority when creating your entity.

Be careful when you form your entity because many online companies initially say that there are no extra fees but as you fill out the forms and information they keep trying to tack on additional fees.

What you initially see is not what you get.

Choosing a State for Formation

Although we will not recommend an actual state where you should set up your LLC, most people usually set it up in their own state. We will tell you, however, that there can be advantages to setting up your business in other states. Some states have tax advantages. Nevada, Delaware, and Wyoming are 3 popular states for setting up your entity for tax reasons and other advantages.

If you are unsure of where to set up your entity, ask your accountant.

Getting an EIN number

An EIN is your employer identification number (also known as a federal tax identification number) and it is simply used to identify your business entity. If you use our recommendation of Inc. Authority they will go through the whole process and get you an EIN number.

If you are setting up your entity on your own, you can go to IRS.gov to apply.

Where do I get my LLC entity formed?

Again there are many options online, but we recommend using Inc. Authority because they are always 1oo% free. You only pay the required state fees.

See our full review of Inc Authority to learn more.

When choosing a business name, it is a good idea to avoid names with the word “credit” or “credit repair in them”.

Some merchant accounts, lenders, and banks might label you as high risk and it may make it harder to get a merchant account with good rates.

The reason that a credit repair company is considered high risk is due to the fact that their customers sometimes default on their credit and debit card payments, which gives you chargebacks which banks do not like.

If you already have merchant processing in place, then you can skip this step. In any case, you should take your time to think about naming your business. Try to make it a brand double, memorable, and marketable name.

Get unsecured business credit lines for $50,000 – $200,000 at 0% interest

Yes, you’ve read that correctly. It may seem too good to be true. But it’s not.

We’ve partnered with Fund and Grow to help entrepreneurs to get business funding. Watch their free business funding training video to learn exactly how it works. Or keep reading to see how truly remarkable this program is.

This is an outstanding program for both start-ups and seasoned entrepreneurs alike

Fund and Grow DOES EVERYTHING FOR YOU. They go out and use their connections and negotiating skills to get you the business credit you need. You just sit back and relax while your credit card offers come rolling in! See below how amazingly easy it is for you to get the funding that you need.

Limited Time: Fund and Grow is offering 2 for 1. You sign up and they will get business credit for your friend, spouse, partner, business acquaintance, or whoever you want!

Check out the free training to see how it works

Check out our full in-depth review of Fund and Grow.

Or watch the free training right now.

Setting up a business bank account

Tip: Do not pay for checks in a fancy binder at a bank. Buy your business checks online. You will save about $100. CheckAdvantage has checks starting at $11.

Establishing credit – This may not be on your bucket list when you’re starting out, but we recommend that you establish business credit. You want to separate your personal credit from your business credit.

If you have established and have managed business credit responsibly previously from any other businesses or entities, you should be OK with your chances of getting more credit. If you have no established credit at all, the banks will look at your personal credit profile.

If your current personal credit profile is not that good, we can help! As mentioned in the previous section of this post, we are partners with Fund and Grow. They will start repairing your credit so you can get a reasonable score to establish business credit.

They will do all of the work for you and get you $50,000 – $250,000 in unsecured business credit lines. Check out their free business funding training video to see how it works. They can help you to et credit faster if you have a good credit score. Even as fast as 2 to 3 weeks!

Merchant Processing Account

Most people will choose the bank that they already have a bank account with. But you could and should shop around for better deals and better credit card processing rates.

Many people also use PayPal or Stripe as an easy way to collect credit cards.

Some of the higher-end credit repair software programs like Credit Repair Cloud will have integration with your merchant processing payment gateway.

Tip: Remember, credit repair is a high-risk industry in the merchant processing space. So you’ll need to find a merchant that works with high-risk accounts. If you choose Credit Repair Cloud as credit repair software, they have everything under one roof including payment gateways, CRM, training, a website, and hosting all put together for you. Check out their free training video to see if they may be the right fit for you.

Local state laws, licenses, and bond requirements

Click on the image above to search by state

This is an important step that we’ve seen some entrepreneurs miss when working from home.

We want to make sure that when you’re starting your credit repair business that you are fully compliant with the laws that essentially govern the credit repair industry in the US.

Federal Laws – The Credit Repair Organizations Act

The Credit Repair Organizations Act was created to protect consumers by not allowing credit repair entities to make false claims about their services.

You should fully familiarize yourself with the CROA as it is fully enforced by the United States Federal Trade Commission. The reason that this is important is that if you are not fully compliant with their legal requirements they could shut your credit repair company down.

The laws were created for the protection of the consumers that are using credit repair services. Essentially, it prevents credit repair services from taking advantage in any way shape, or form of the consumer. To paraphrase some of the requirements, credit repair companies must be fully transparent about the services that they offer and they must not make any false claims or guarantees to the consumer. You must also give a written contract to each consumer that gives them the ability to quit the service at any time and lastly, your company is not allowed to charge customers in advance for any services. Some type of work must be performed before you charge the consumer.

Local laws by state

One of the most common laws by state disallows the credit repair service to charge clients upfront before any work has been started.

You should understand and have a pretty good familiarity with the laws in which your business is operating in.

Here is a great starting point for you to look up each state quickly and easily.

Using the link above, you can also find the statute of limitations and any state requirements for a credit repair license.

Meeting All Regulatory Requirements

There are a few regulatory requirements that you should know about right away.

Becoming bonded and insured. This depends on your state. Some states require that you get a surety bond. Other states do not require a surety bond. You need to check on the regulations in your state to see what the bond and insurance guidelines are for operating a credit repair business. This varies a bit from state to state. A credit repair surety bond protects and covers your customers in the event that any type of harm was caused because of the actions of your company

Getting a business license. If you are going to open your credit repair business, you need to have your business license before starting. Be sure to get this before officially starting your business.

Register with your state. Not all states require registration. About half of the states (about 50) do require registration. If required, you simply need to fill out an application and pay a fee to officially register with your state as a “Credit Repair Service Organization”.

Retaining a Lawyer

1. Having a credit repair lawyer available is handy if you are accepting clients from different states because they can prepare per-state client service agreements for your credit repair clients.

2. If you are ever not compliant in a state and get charged fees, it is good to have a lawyer handy to consult with to see what your rights are and what you might need to do to become compliant in that particular state.

For your convenience, we can recommend one of the most popular lawyers in the credit repair space, Robby Birnbaum. His number is 954-343-6959.

Robbie is involved with NASCO (National Association of Credit Services Organizations) which oversees the credit repair industry for compliancy, so it’s safe to say that this man knows his stuff.

You can call him with any questions, and if he doesn’t help you himself he can put you in the right direction.

This is not mandatory but we highly recommend joining this great non-profit organization so you can proudly carry the certification by the National Association of Credit Services Organizations.

We are not affiliated with this organization whatsoever, and their certification process is a little involved, but having the certification can help you stand out from your competition.

It is a good pitch for your clients too because the certification does cost you a fee and the organization as a whole was formed to protect the consumer by making sure that your company is compliant with the credit repair laws.

They advocate strict industry standards through their Standards of Excellence seal promoting compliance throughout the industry.

There is a $299 upfront fee and then a $49 per month membership fee. You can learn more here.

If you are staring up on a shoestring budget, you can skip getting your Nasco Credit Certification for now.

We suggest that you at least familiarize yourself with the Credit Repair Organizations Act.

As your business grows, you can then re-consider joining Nasco.

Get set up with credit repair software

If you are going to start a credit repair business from home, you are going to need the proper software. You can’t run this type of business without credible software. Choosing a good software will help you with customer relationship management, staying organized, automation, payment gateways, and much more.

Before we get too deep into this, let us just tell you right now our number 1 recommendation. It’s Credit Repair Cloud. The reason is that this software literally has everything built into it, including a robust customizable, and easily manageable website builder where you can create an amazing website for yourself.

See our full review of Credit Repair Cloud. Also, see our review of their masterclass, where they train entrepreneurs on how to get their business rolling right out of the gate.

If you want to see all of the credit repair software options, click here.

Whichever you choose, you’ll want to find software that has the following features:

Easy-to-use.

Ideally has a payment gateway and a robust website

Has free support and training

Attracts clients with built-in marketing tools

Allows you to easily manage your contacts.

Helps you organize your clients and brings in results quickly

Allows you to track the progress of each credit inquiry

Has a website builder inside the program

Credit Repair Cloud offers 4 options

Option 1 – Free 30 Day Trial

Try the software for free for 30 days.

Give it an extensive test run.

There is no Initial charge for you to just try the software

>>>>> Sign up for their 30-day unlimited use trial <<<<<

Option 2 – Take the Free Credit Repair Cloud Training

This is a great option if you are still on the fence or if you just want to see if starting a credit repair business is for you.

There is no obligation to purchase when you take the free training.

>>>>> Sign up for their free online training webinar <<<<<

Option 3 – Purchase The 6-week extensive Credit Repair Cloud Masterclass

The cost for the 4-week training is $997. This includes free use of the software for 6 months, all of the training, and live coaching.

There is a 30-day money-back guarantee for the Masterclass.

>>>>> Sign up for the 4 week Masterclass training <<<<<

Option 4 – The Credit Hero Challenge

There is a one-time payment of $47 to join the 14 day Credit Repair Challenge.

You will get four workbooks in the mail and a certificate of completion when you finish the course.

The training focuses on getting your business up and running within days.

>>>>> Sign up for the 14 day Credit Hero Challenge <<<<<

Normal monthly pricing

The use of the software is just $179 per month

Other credit repair software options

There are other credit repair business software companies.

Once you have found the right one, you can move onto the next step.

Do I need to use credit repair software? No. You do not have to use any software. Some businesses start out on spreadsheets or other customer relationship management tools.

Using software like Credit Repair Cloud (see our full review) has many advantages including a built-in website (so you do not have to create a website on your own) the organization of clients, automaton to save time, pre-built customizable dispute letters, credit report reporting, training, mentorship, payment and invoicing integration, and scalability for growth among other features.

Is there free software? Not that we know of. But if you do not see the value of the features of using software or if you are on a really tight budget, you could start out with a free project organizer like Trello.

Professional Credit Repair Training and Preparing Your Credit Repair Business for Opening

If you are going to operate a credit repair business, it is very important that you fully understand how the process of credit repair works.

Investing time before you open your business will help you to have a more successful business.

There are many different training materials and programs out there.

The credit repair training that you will want should include the following:

These are some of the best things you will learn with credit repair business training. If you can learn all of this or even more, then you will be set to start getting your credit repair business ready to open.

3 great options on how to get credit repair training are below!

The Credit Repair Cloud credit repair software offers free training if you are looking to start your own credit repair business. The training covers all of the above points plus a whole lot more. Their training guides entrepreneurs on how to start a credit repair business from home with no previous experience.

Another great option is to take a self-paced training course to become a Board Certified Credit Consultant, and Certified Credit Score Consultant with the Credit Consultants Association (CCA). They are a trusted non-profit trade association. If you pass your test, you will get a certification certificate that is widely respected in the industry. It’s $99 for both certifications or $59 for just the Board Certified Credit Consultant.

You can also take an online 5-hour video course for $25.99. All of these options offer different materials and strategies, We recommend you take all 3.

Preparing Your Credit Repair Business for Opening

Okay so hopefully up to this point, you’ve decided that you really want to work from home and you understand the benefits of working from home with your credit repair business!

You’ve created a business plan, formed your LLC, checked your state for its laws and requirements.

You’ve got your certificates, your software, and have gone through some training.

That’s great! That brings you up to date so far!

Starting a business can be daunting and not having mentorship can make it even more confusing.

So we highly recommend that if you’re starting a credit repair business from home…

Don’t try to do it on your own.

Why not take the fast track to success with free training?

Take a free training class offered by Credit Repair Cloud.

This is really starting to get exciting!

You’ve collected a lot of information and hopefully, you have started some of the balls rolling.

If you want to get into an immediate training class and learn how to can get started quickly, click here.

You will learn how to get started, how to easily get leads, and how to market your business in this free video with Daniel Rosen from Credit Repair Cloud.

Daniel Rosen is a credit expert.

Remember having mentorship will increase your chances of success.

Otherwise, let’s proceed with our other action items!

In order to have a successful credit repair business, there are a few other things that must be done first.

Make sure any employees that you will have (if any) sign non-disclosure agreements and make sure they are all trained, as well.

Determine which payment arrangements can be made by your clients.

Determine what type of payments you will allow. PayPal, debit cards, and banking accounts are all common options.

Create a client agreement form that keeps your business protected and helps to show your client’s your business is reputable.

Once you have done these things, it is time to move your credit repair business a little further down the line.

It is time for you to build your website.

Building a Credit Repair Website

You are going to need credit repair software to run your business as we’ve covered previously, and some of the really good ones like Credit Repair Cloud offer a complete business in a box where you can make a really gorgeous website easily with the software.

If you go that route, you can skip this step

If your software does not come with a website, you can follow the steps below so you can get online as quickly as possible.

Model other sites

Take your time first and scour the Internet for other credit repair websites that you like. You can also search other similar sites in your vertical. For example financial websites, lending websites, professional consulting websites. It doesn’t really matter, you’re just trying to find a style that you really like so you can either try to create one on your own or show a developer.

Planning is crucial at this stage

You want to make sure the credit repair business website that you create is going to attract potential clients and even convert their visits to the site into sales for your business services. (You do not want a website like the one pictured above) LOL

Do it yourself

There are dozens of web platforms where you can build your own website. One reason that we would not fully suggest this method is because you’ll be tied into a monthly payment, and on some of the sites you may not actually own your data.

If you do want to do it yourself make sure you use WordPress. WordPress is the #1 opensource website building platform in the world and it is free.

Having someone create a site for you

A couple of other advantages of having someone create a site for you is that they can put it on WordPress which is a free open-source platform and you will have the flexibility of brainstorming with someone that knows what they’re doing and developing your website to its fullest potential.

Having someone that knows how to monetize websites is also a huge advantage

There are certain things that your website should feature (besides a clean professional design)

A portal so that your clients can sign in and see their progress

Create very simple and clear call to actions to get your clients to do what you want

An informational blog is very helpful in generating leads and customers. We’ve seen many entrepreneurs not create content. Make sure that you build content on your blog

Free consultations. This will give you client information and help you to determine how interested a client is in your services. Also appropriately timed and placed pop-ups. These should be offers, not ads.

Leads tracking and lead capture. The website should have a sign-up feature for clients, so you can track who is interested in your services. You’ll want to collect their emails so you can retarget them with email marketing.

Hosting | Getting your website live

You will need to buy a domain name with a registrar and then set up your site with hosting. Make sure that whether or not the credit repair software that you’ve chosen offers domain purchasing and or hosting. Some offer both. If they do know you can skip these next few steps. If they only offer one or the other or neither, read on below.

What is a registrar?

A registrar is simply an online service where you buy your domain name from. Typically domain names cost around $11.99 year. One of the most branded registrar companies is GoDaddy. Think of your domain name as the same as when you registered your LLC business name. It’s just a name that has to be registered somewhere.

What is web hosting?

Hosting is simply a company that puts your website on their server and displays it to the world. Think of buying a new TV. The would not show you any images, channels, or movies until you purchased a provider like Verizon or Netflix. So hosting is simply a provider. Hosting typically costs anywhere from $3.99 a month upwards to several hundred dollars depending on how big your website is. But for the most part, when just starting up, you should only need a small plan.

We recommend using companies that have the registrar and hosting under one roof. It’s just easier for management, but it’s not necessary.

Hosting Options

One of the most popular hosting companies is bluehost.

bluehost has easy 1 click WordPress integration and they are very affordable at around $3-4 per month for hosting.

They also have 24/7 support which many other hosting companies do not offer.

They also offer a free domain for the first year and a free SSL certificate (value around $65).

The platform is very beginner-friendly too!

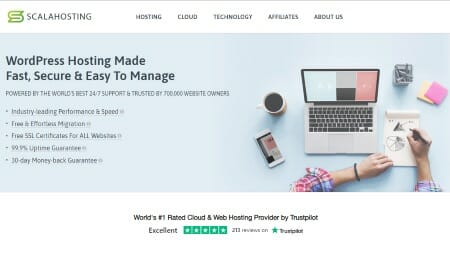

This is another highly recommended hosting company that offers a free domain, free SSL certificate, and 1 click WordPress install.

WebhostingPad offers free setup with no hidden fees.

Free website transfer.

Free web builder too!

WordPress Hosting with unlimited email, SSD Speed Enhancements, malware scanning, and WordPress-Optimized servers. All for $2.99/month.

Free SSL and a 30-day money-back guarantee.

Unlimited disk space

1-Click WordPress installer

The Best WordPress Hosting For Your Web Site – ScalaHosting.com

After your credit repair business website has been finalized and created and you are online, you get to determine how clients will communicate with you.

Preparing for Client Communications

You want to make sure you are ready to allow them to communicate with you.

In order for them to do that, there are certain communication methods that you may want to consider or set up.

These are some of the things that you will need to do if you want to improve the communication between you, potential clients, and even future clients. After you have set all of these things up, you will need to make sure any employees are trained.

Training Your Credit Repair Business Employees

Certain training methods should be incorporated to ensure they are a good fit for your business.

After you have created a training program and trained any employees that you currently have, you will need to make sure you are meeting all regulatory requirements.

Sales

We have briefly talked about sales a little earlier in this masterclass.

Sales one of the most important aspects of running your business besides marketing.

I don’t care what anybody tells you, you cannot run a successful business without knowing how to do sales.

Some people can sell naturally. Some sell without even knowing that they’re selling.

And others need a lot of work.

If you are not cut out for sales, the good news is that you can hire somebody to answer phones and do sales for you.

The true (one-word definition) and the secret to sales

Knowledge.

It’s that simple. The more you know about how to repair people’s credit and the more you know about your product, the easier sales become.

You’ll also need to know the pain points of your customers but will go over this more in marketing.

Sales and marketing are very related.

The Basics of Sales (That you should work on mastering)

For now, we are going to go over an outline of all of the things you should eventually learn and master so you can put together a solid sales training deck.

For a sale to happen: You need to solve a problem for your customer and your customer must believe in you, your product, and your company.

Don’t be pushy – Simply educate your potential clients

Learn to master the art of sales to grow your credit repair business. Do not be pushy. Educate your customer and solve problems for them.

Now that you have a good outline about some important elements of sales, put a training deck together. In that deck should be a couple of solid sales pitches as well.

Marketing

But let’s dive into a little bit more depth here.

We will be discussing digital marketing as a whole, but more specifically we’ll touch on email marketing, retargeting, social media marketing, media buying (running ads), and some SEO.

Learn as much as you can and outsource the rest

When you get your website entity up and running we highly recommend that you either learn how to do as many aspects of digital marketing as you can or if you cannot initially learn or if you do not have the time, you should implement outsourcing by getting some remote personal assistants to effectively carry out marketing tasks for you (and on a budget too!).

One of the common mistakes we see is that people build their websites in the hopes that people will come and they do not do any type of marketing for their business.

They almost always fail.

Don’t do that. Work on it as hard and as much as you can.

Put some effort into marketing and you will see the fruits of your labor over time!

Here is some really good news!

The good news is that even though you may think credit repair is an extremely competitive vertical, there is still plenty of room for you to do some strategic and creative marketing on your website. If you work on it, you can surely capture a market share in your space.

We have been in this vertical for over 15 years and have seen 100’s of companies that simply do not work on growing their business through digital marketing channels, and they fail.

Trust us, the more that you put in the more that you get out. Especially when your competitors are not.

1. The 1st step that you should take is to create a Gmail account.

2. Then create a Google Search Console account and attach your website to the Search Console. This is where you communicate with Google about everything related to your website. It is in your Search Console where Google will let you know if there are any major issues with your website and how you can fix them. You can see what people searched (the keywords) on Google to find your pages. In Search Console is also where you can upload your XML Sitemap. This tells Google about the pages that you have created on your website.

3. Set up a Google Analytics account. Simply sign up for Google Analytics and add your website and then take the analytics code they give you and add it to your website. This will help you track your visitors and where they are coming from. You’ll get a lot of useful data like what pages they go on, how long they stay, your top-performing pages, and much more.

4. Then set up a Google My Business account and optimize it by adding your business pertinent details.

Create Social Media Accounts

You can start with the main ones, Facebook, Twitter, Instagram, and Linked-in.

Generating Leads with Social Media

Let’s face it. To run and grow a successful business, you need leads. Lead generation and getting traffic and eyeballs on your service are imperative.

Right now, the hottest social media platform is Tik Tok. You can generate organic FREE leads by utilizing the Tik Tok Platform.

If You Want Free Leads, You Need to Take this Course!

We have partnered with an amazing marketing company called Legendary Marketer. Legendary Marketer helps individuals to launch and grow successful businesses and they have created an amazing course that shows you how to generate leads on Tik-Tok.

This course is a game-changer for you to get FREE leads to grow your credit repair business.

The course offers specific strategies on how to find endless ideas for content, setting up your profile to maximize traffic, and how to get started on the platform very quickly.

The course is called “15 second free leads” and is just $1.

If you are strapped with time in the beginning or are just overwhelmed, at the very least, you should create a Tik Tok account or a Facebook business account, or both.

You can hire somebody very affordable on Fiverr to help you set up or manage these social media accounts for you. They can help build you an audience and they can get the word out on your recent social media posts.

Build a blog and build a lot of quality content

This is another mistake that we see a lot of marketers make. You need to have quality content on your website. And it needs to be completely authoritative in the credit repair space.

What is a good blogging plan?

Become an authoritative brand and an expert in your field by creating extremely informative and topical blog posts about credit repair and your service.

Content marketing is still king to drive traffic to your website. You need to write very long in-depth content pieces that solve problems for your potential clients. The average blog article should be at least 3000 words.

This page that you are on right now is an example of an authoritative blog post. It is filled with an immense amount of valuable information (well we at least hope you think so) :) and it is very authoritative. It is also over 8,000 words long.

Email marketing

Email marketing is still the number one form of marketing for digital marketers.

Get yourself some good email software and start collecting email addresses from your visitors.

All you need to do is to put capture forms on your website so that you can re-contact your leads and wean them through your sales funnel.

Creating educational content and really strong related lead magnets will help you to collect emails.

Beginner email marketing

If you are just getting started and you are confused about all of the different email marketing platforms available, we highly suggest that you take a really good look at Moosend. This small company has grown a recent times in his put together a really strong all in one marketing platform.

The best part? They have a free plan that you can use the platform 100% free until you get your first 1000 subscribers.

This is a great way to start off your email marketing campaign for your business. You can send out unlimited emails and create sign up and subscriptions forms and a whole lot more.

Advanced all in one platform

When I personally was first looking for email platforms back in the day they were only a couple of major ones like A Weber, Constant Contact, and GetResponse. Then others started coming on board like MailChimp, SendinBlue, and Convertkit.

Then all of a sudden there were literally thousands of them! Some of them are still pretty good and I would recommend them.

But trust me, and take it from me I have tried many of them and every single one of them was either missing something that I needed or I had to get another platform to use in conjunction with it because it wasn’t all under one roof.

And then I found Kartra.

Kartra is by far the absolute best all-in-one marketing to run your business.

If you’re serious about growing your business check out all the features that you get with Kartra.

You can build emails, email sequences, and autoresponders, squeeze pages, opt-in forms, drag-and-drop check-out pages, sales pages, sales funnels, lead capture forms, and more.

If you want to create videos and or create webinars it’s all available to you for one monthly price. Oh yeah, you can build membership sites and your own affiliate management platform. Great for building your credit repair affiliate empire.

See our in-depth review of Everything that you get with Kartra.

SEO

This is a big subject so we are just going to go it over briefly.

SEO stands for search engine marketing. When you build your content pages on your website, you will need to learn how to optimize your content for search engines. SEO is simply the process of getting your website visible, and preferably in the top 3 of the search results for your search terms in the Google (and other search engines) results.

On-Page SEO

On-page SEO includes writing effective meta-tags, adding headings to your pages, adding quality images and optimizing your images, adding alt tags to your images, and more. This includes working on your technical SEO where you should make sure that you are canonical redirects are correct, your 301-page redirects are correct, your meta-title tag lengths are correct, and that there are no broken links internally or externally on your website among other things.

Here are your first few steps with On-page SEO:

1. Do extensive keyword research on your competitors to find keywords to shoot for so that you can create quality content to help drive organic traffic to your website. Look for long-tail keywords (low-hanging fruit) to build content around. A long-tail keyword is a very specific targeted keyword. An example would be: “how to raise credit score by 200 points” instead of “raise credit score”. You can outsource a content marketing strategy for your business.

2. Create quality content. Once you find low-hanging fruit (blog ideas) from your competitors, start writing content (blog posts) that are better and more in-depth than your competitors. Write as much content as you can. I would shoot for two (very informative and well written) 3000 to 4000-word articles a week.

3. Learn how to optimize your content by learning how to write filenames, alt tags, and meta tags. If you have no clue about SEO, again you can outsource it to someone on Fiverr.

4. Work on constantly improving your existing content. Keep improving your website by always adding more (and better) pictures, add videos, and tweak your content so it stays relevant.

Off-Page SEO

This is where you would concentrate on getting high-quality backlinks from other related websites. If you write amazing content, and you share it socially, and then promote it with outreach, you will be able to get organic backlinks which just happen naturally.

Getting quality sites pointing back to your site is a trust signal with Google. This will help your site rank higher in the search engines.

How can you get some backlinks quickly?

Submit your business to some quality local directories

We are talking about the quality directories that matter like Company.com and Brownbook.net to name a few.

Adding your websites to quality directories will help your business show up in the local Google map results.

The Long Term Advantages of SEO

By working to improve on your search engine optimization on your credit repair website over time you will reap the rewards of eventually getting organic traffic, and ultimately sales. SEO does take time so you should always constantly be working on it so you can beat out your competition in the long run.

Again, if you do not have the time, skills, or the know-how, you can always outsource SEO tasks on freelance websites like Fiverr.

You can search for tasks like “build quality backlinks”, or “on-page SEO”, off-page SEO, and technical SEO to get help from freelancers on Fiverr.

Best Marketing and SEO tool

Sem Rush

With this tool, you can see so many valuable metrics about where you stand in the SEO and marketing world.

You can set and see valuable benchmarks about how you stack up and compare to your competitors.

Some of the many features include viewing at a quick glance all of the keywords you are ranking for in the search engines and then having the option to quickly compare them to what your competitor’s keywords are.

This tool is so many features, so we will keep it brief.

One of our favorite features is that you can spy on your competitors and see what they are doing with their ad spend.

When you test drive the tool by inputting your URL into the form below, you will be asked to sign up to get 10 free searches for competitors. There is no obligation, and you can stay on the free version for as long as you like.

But unfortunately, you do have to opt in to make your free searches.

As you can see, you can outsource just about anything.

See our complete in-depth guide about outsourcing out outsourcing.

Hope this helps you to get some good reliable virtual assistants!

Facebook ads and PPC

“Should we serve ads?” This is a question that we get asked all the time by new companies.

The short answer is absolutely yes. If you spend some money and run ads on Google, Bing, and/or Facebook you will have the ability to get instant traffic.

If you’re on a budget, this may not seem like it is not an option for you. But we urge you to diversify, by not only carrying out almost all of the recommended tasks on this page but also the try to spend some money in the beginning on running some ads.

You can start with a small budget of $5 a day to test the waters.

Here is a pretty good affiliate marketing course that gets deep into how to run Facebook Ads.

Payroll

Payroll – Payroll companies are relatively inexpensive these days. It is recommended that you use a payroll company even if you are on your own. This will reduce stress-free when it comes to paying your own taxes at the end of the year. As a business owner, especially one that operates out of your home, you should be paying quarterly taxes. Put this on your calendar, so you don’t end up running into any problems in the future.

Bookkeeping

Some of the credit repair software that we recommend, has some bookkeeping features in the software. Otherwise, it is recommended to get a bookkeeper to at least be your books quarterly and get them ready for your accountant. If your savvy on this and you can absolutely do your own bookkeeping.

Accounting

If you have an LLC or corporation we highly recommend that you use a real certified accountant. There are legal advantages as well as protection for your company when using a CPA. Even if your revenues are not that high in your 1st year, it is always a strong idea to hire a real accountant.

This about sums up the process of starting a credit repair business from home.

Hopefully, this all helps you to get your business ready and started.

Grow And Expand on Your Business Quickly!

Here are some ideas on how to blow your business out of the water!

1. Get Affiliates to Promote for you

Having a strong referral system in place can really catapult your business. You simply pay a commission for each lead that is recommended to your business that signs up with you. The big players like Lexington Law start affiliate programs where they get hundreds if not thousands of affiliate partners to drive traffic and leads to their website.

2. Add a debt elimination Service

Not only can you help your customer by repairing their credit, but you can also help them eliminate their debt entirely. All you have to do is sign up as an agent with this amazing company called United Financial Freedom, and share their award-winning debt elimination software. It cost you just $149 a year to become an agent and you can make anywhere between $400 up to $800 for each client enrolled. You can also build a downline and team underneath you where you can make overrides. This is a great addition to any existing credit repair business. The fee to get started is minimal and there is no overhead. Learn more here.

3. Start an Affiliate Marketing business

There are literally dozens of services that are related to credit repair that you can tack on and sell to your customers and make money through affiliate marketing. Companies like Experian Boost (where they help customers get a quick bump in the credit score) will pay you a commission for each referral. There are many credit monitoring services that will pay you a commission for a referral. You can also sell a wide range of affiliate products on your website including credit repair help books. If you want to take a course to learn how to build an affiliate marketing company, we highly recommend Authority Hacker. It is bar none the best affiliate marketing course available online.

4. Start your own Judgement Recovery – Small Claims Processing Business

This is a great legitimate side business that you could add on to your existing credit repair business. You can make a really good income, work your own hours and there’s a lot of work out there. The best part is that there is no selling involved. The process of judgment recovery is simply collecting money from debtors who were ordered to pay a creditor by a court of law. When the court makes an order or judgment for a payment they do not enforce the payment. The liability is what the plaintiff to collect the money. That is where you would come in as a judgment recovery specialist. Learn more here.

Resources & Recommended Reading!

Watch a free credit repair training seminar to learn exactly how to start a credit repair business

See our in-depth review of Credit Repair Cloud. This software will help you manage your clients effectively and easily so you can scale your business very quickly. If you really want to learn how to start a credit repair business, they also offer some of the absolute best credit repair business training in the industry.

Learn how credit repair outsourcing can help you to manage your daily tasks so you can catapult your business very quickly on a budget!

Learn more about the true opportunity of having your very own credit repair business.

Read our in-depth review on how you can start your own debt elimination business for under $200.

See the all-new debt help section of our site.

Here are some really cool credit repair loopholes that you need to know to help you to repair your credits credit quickly.

Learn some cool secrets on how to raise your credit score fast for your clients. Make sure you read the secret sauce (Tip #6)!

If you need an all-in-one marketing tool to help you run your business and collect leads, check out Kartra!

How to write effective and successful goodwill letters that really work for your clients.

Please take a few moments and visit our blog for more credit repair-related resources.

Thank you for visiting!