Here’s How Often You can Get Your Transunion, Equifax, Experian Free Credit Report

You can get a free credit report from all three major credit bureaus once a year or every 12 months.

Consumers are entitled to getting a free credit report and not having to pay for it from TransUnion, Equifax, and Experian.

The easiest way to obtain your report is to do it online from AnnualCreditReport.com.

According to their website, they are the only source that is authorized by federal law consumers where consumers can get their credit reports for free.

NOTE: It is important to note that when you get your free credit report it will not come with your FICO score.

All three of the major credit bureaus are required by federal law to provide consumers with an annual credit report whether it be through AnnualCreditReport.com or directly from credit agencies themselves.

Can I get a free credit report directly from Experian?

Yes, you can. Experian offers both a free monitoring service and paid monitoring service.

With their free service, consumers can sign up and get their credit report instantly with a free FICO score as well.

Can I get a free credit report directly from Equifax?

Yes, you can. All you need to do is sign up for a myEquifax account.

Then once you log in, simply look for “Equifax Credit Report” in your myEquifax dashboard.

Can I get a free credit report directly from TransUnion?

Yes, you can also get a free credit report directly from TransUnion.

When you sign up with TransUnion, your annual credit will be available for free.

Understanding your credit report

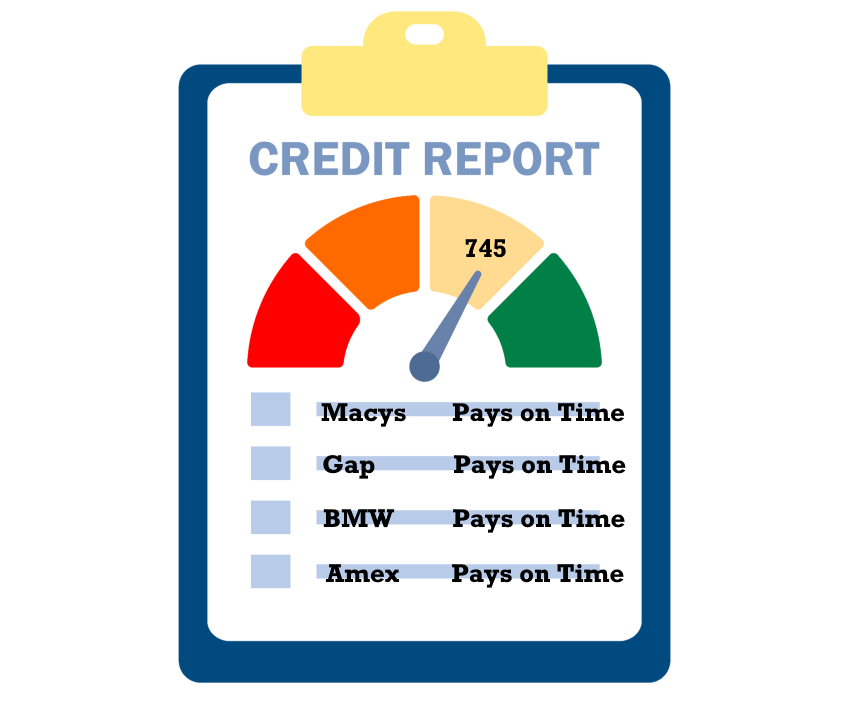

What is a credit report?

A credit report is a statement that has information about your credit activity and the current credit situation such as loan paying history and the status of your credit accounts.

A credit report credit is essentially a summary of how you have handled your credit accounts.

Your credit reports are generated by third-party credit bureaus. The main three are TransUnion, Equifax, and Experian.

These three major credit bureaus sell your information to creditors and lenders. The reason that creditors and lenders buy information is that they want to see your credit worthiness. It helps them make their decision on the types of loans and the rates on the loans that you will be getting.

It is very important to pull your credit reports as often as you can to check for accuracy.

If there’s any erroneous or misleading information, it can hurt you and can keep you from getting the loan that you need.

Your credit report is very important | Make sure you constantly monitor it

Your credit report can be a major factor in your financial life. Your credit report contains a history of all your credit accounts, including the start date from when you opened the account, your current balance, and your payment history for the account.

Checking and monitoring your credit report is a simple way to be proactive about your creditworthiness. Checking your credit report regularly will help you spot fraud early and ensure that the bureaus’ correct information is provided.

It is in your best interest to check your credit report as often as you can to be sure that the information in your credit report is accurate.

If there is incorrect information about you on your reports, you will need to dispute them with their respective credit agency.

If you have stubborn negative items that are appearing on your credit report that you are not able to get updated or removed on your own, you can try hiring a professional credit repair company to aid you in getting the erroneous information removed.

Here is our pick of the #1 credit repair company if you need help

Sky Blue Credit Repair has been in business for over 30 years and they have an A+ rating with the Better Business Bureau.

With Sky Blue Credit Repair, you also get a 90-day money-back guarantee.

They are experts at going through your credit reports with a fine tooth comb to find erroneous information. They also know all of the legal credit loopholes that they can leverage to clean up your credit very quickly.

Sky Blue Credit can fix up your credit for you. Their service is just $79 per month and you can quit at any time.

Learn more about how credit repair works.

Top 3 Reasons that you should check your free credit report

Related Reading if you have debt

Learn how to raise your credit score fast.

See the true benefits of having good credit.

Here is how to write an effective dispute letter to the credit bureaus.

If you need help cleaning up your credit, see our reviews of the best credit repair companies.

Leave A Comment