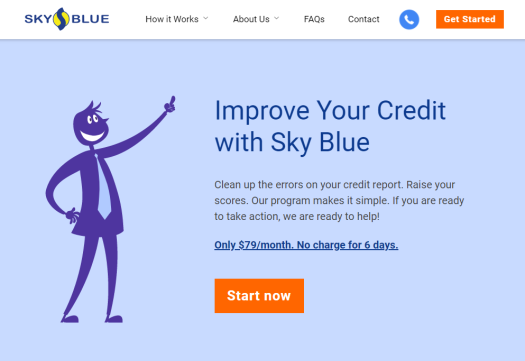

Are you considering repairing your credit, but can’t decide which service to sign up for? Then you have come to the right place! Our experienced credit reviewers have compiled below a side-by-side comparison of two of the top credit repair services in the nation: Sky Blue Credit Repair and Lexington Law. We have compared all aspects of each service so you can best decide which one to go with. Get ready for 10 rounds of head-to-head action from these two great credit repair contenders. Now you can decide for yourself: which is better, Sky Blue Credit vs Lexington Law.

Sky Blue Credit Repair vs Lexington Law | Which Service is a Better Choice?

Lexington Law has been providing excellent credit repair services for over 27 years. With 200 paralegals and agents across 19 states, they ensure the highest standard of credit repair in the country.

Tale of the Tape: Sky Blue Credit

Sky Blue has its own amazing resume with over 30 years in the industry as well. They have a super clean record with the BBB and they offer the best money-back guarantee in the business.

Round 1: Pricing

Pricing: Lexington Law

3 different pricing plans: $89.95, $109.95 and $129.95. Sign up for one of the plans and after 5 days you will be charged an $89.95 first work fee. Then 30 days from that you will be charged for whatever plan you chose.

Pricing: Sky Blue Credit

1 simple pricing plan. No initial charge when signing up. Then after 6 days, after they have started working on your file, you will be charged a setup fee of $79.

And then it’s just $79 every thirty days. You can quit at any time. There are no long-term contracts

Thoughts and comments:

Sky Blue Credit offers everything for one simple price.

There are no extra charges with Sky Blue for getting a credit score analysis, debt validation, goodwill letters, cease and desist letters, debt settlement/negotiation consultations, or help with rebuilding your credit.

Sky Blue gets a big edge here when it comes to price, the value of what you are getting, and the simplicity of the pricing.

Who wins round 1 – For Pricing?

This one really isn’t even close

Sky Blue has a simple pricing structure

Sky Blue Credit offers more features and value for less

Round 2: Guarantee

On the Lexington Law website in their FAQs section, Lexington Law states that unfortunately because credit repair is never guaranteed, they do not offer a guarantee. Not fully standing behind your service is a tough one for us to swallow. It just doesn’t make any sense. They should consider offering some sort of warranty or assurance.

Guarantee: Sky Blue Credit

90-day full money-back guarantee.

If you are not happy for ANY reason from the date that you signed up, you will get your money back. Whatever you have paid during the 90 days will be refunded.

This is by far the best guarantee in the entire credit repair industry.

Thoughts and comments about Lexington Law’s Guarantee

Thoughts and comments about Lexington Law’s Guarantee

Sky Blue Credit has a guarantee that is crystal clear.

There is no smoke and mirrors with the Sky Blue guarantee. Even if a client has had some deletions realized from the Sky blue efforts during the 90 days and even if the client is being unreasonable and just wants a few months of free service, Sky Blue does not care and will give them their refund. Because Sky Blue works hard on each and every case, they are confident that in the end, they will show the best results and win the trust of the client in the first 90 days.

Sky Blue gets another huge edge here when it comes to their guarantee. They back up their service and their brand by giving their clients some peace of mind that if it is not working out, the client can get their money back. Clients have nothing to lose and a better credit score to gain. This shows that Sky Blue Credit stands behind its service 100%. There is a lot of comfort in knowing that if they cannot get the job done to our satisfaction, they will stand behind their service and do the right thing and give you a refund.

As far as the overall pricing and the value that you get for what you are paying for goes to Sky Blue Credit. And a 100% money-back guarantee for Sky Blue Credit against no guarantee from Lexington Law also makes this a no-brainer.

Lexington Law hits the canvas twice.

Who wins round 2 – For The Best Guarantee?

Clients have nothing to lose by trying their service

The guarantee is very clear and straightforward

Sky Blue’s 90-day guarantee is the only condition-free guarantee in the industry

This was almost a knockout

But the fight is not over. There is more action to come. If you want to take advantage of the better pricing and the better guarantee;

You can end the fight and get started on fixing your credit right now. Check out the Sky Blue Credit website to learn more or to get started today

Round 3: BBB Rating and Complaints

BBB Ratings and complaints: Lexington Law

Lexington Law is not BBB accredited. In the past 3 years they have over 600 complaints with the BBB and 288 of them (as of 5-28-21) have been closed in the last 12 months.

Lexington Law has a mediocre C rating with the BBB. They also have a sub-par 2.05 total average out of 5-star rating from customer reviews on the BBB website.

BBB Ratings and complaints: Sky Blue Credit

Sky Blue Credit is not BBB accredited. In the past 3 years, they have 8 total complaints filed with the BBB, and 3 of them have been closed in the last 12 months (as of 5-28-21).

Sky Blue has an A+ rating with the BBB. They also have a 4.27 out of 5-star rating with online submitted reviews from customers. These ratings are very impressive and speak volumes about their service.

Thoughts and comments about Lexington Law BBB:

The pending government action has not been resolved and has not yet been proven, so we cannot hold this against them.

Through strong advertising, Lexington Law gets more overall clients, which leads to a better chance of getting more complaints.

Here are the Lexington Law BBB complaints against them and here is their full BBB business profile.

Here are their BBB customer reviews and here is our full in-depth review of Lexington Law.

Although there are many unfortunate consumer complaints, Lexington Law does respond to them on the BBB website. Some of the complaints that we read did not seem completely fair.

We still feel this is a very big law firm that can show results to clients. Visit the Lexington Law website.

As far as Lexington Law versus Sky Blue Credit when it comes to the Better Business Bureau, Sky Blue Credit has a much leaner, cleaner, and better overall record with the BBB.

Sky Blue Credit BBB thoughts:

There is not much to talk about when it comes to the Sky Blue Credit BBB ratings, reviews, and complaints because their profile is sparkling clean. They are definitely on top of their customer service and complaints, so much so, that not many complaints, customer requests, or misunderstandings get escalated to the Better Business Bureau.

Here are the Sky Blue Credit BBB complaint files and their full BBB business profile.

Here are their BBB customer reviews and here is our full in-depth Sky Blue Credit Repair BBB review.

Visit the Sky Blue website.

Sky Blue gets another big nod here for their Better Business Bureau ratings.

Who wins round 3 – For BBB and Complaints?

Sky Blue Credit has only 8 complaints to over 600 for Lexington Law in the past 3 years

Sky Blue has much better BBB reviews from consumers

Sky Blue Credit resolves more cases in-house, which is why more consumers do not go to BBB

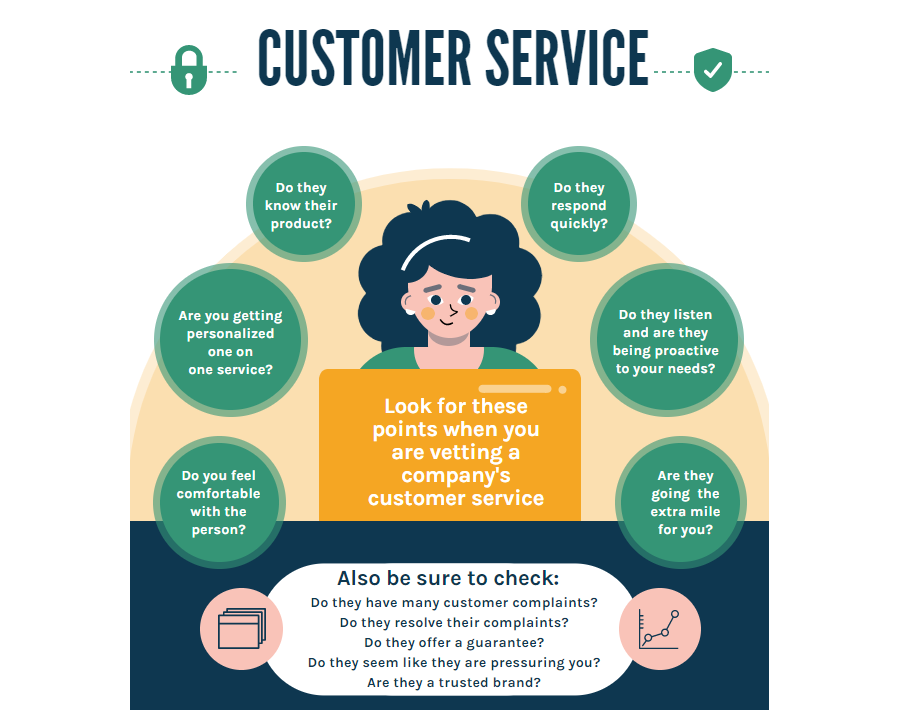

Round 4: Customer Service

Customer Service: Lexington Law Credit Repair

Here we are in round 4 of Lexington Law vs Sky Blue! As many of you know, Lexington is a huge long-standing law firm for sure. Lexington Law works hard right off the bat to assign each new customer to a paralegal and to get them into their customer portal. They have longer hours for telephone customer service that runs from 7 AM to 7 PM Monday through Friday. They have longer sales hours as well, from 6 AM to 10 PM Monday through Friday, and 7 AM through 9 PM on Saturday, and 7 AM to 3 PM on Sundays (MST).

Customer Service: Sky Blue Credit

With a smaller company like Sky Blue, you’ll get more personalized service. Their customer service hours on the phone are from 9 AM to 5 PM Monday through Friday (EST). They are great at answering emails and calling back their customers.

Thoughts and comments: About the Lexington Law Customer Service

There are many reviews across the Internet that state that the Lexington Law team deceived them or misled them as far as the expectations of how much they will accomplish for the client. The other big complaints are mostly pricing issues. But as far as Lexington Law answering the phones and responding to their customer’s needs and requests, they are pretty good. They have a little bit longer phone hours for customer service than does their competitor Sky Blue Credit.

Thoughts and comments: About the Sky Blue Credit Customer Service

Sky Blue Credit offers a more personalized customer service for its clients.

They are a little bit better at responding on the phones and they are a lot better at responding via email.

It is always hard to rate overall customer service for credit repair companies as each client pretty much has a unique case-by-case situation that they need to be dealt with. This is a close call, but when we factor in the overall complaints with the BBB, and resolved issues Sky Blue once again gets a nod here.

We feel that Sky Blue also has a better sales team, where they do not pressure their potential clients into signing up. Lastly, they pack up their customer service and overall services with an ironclad guarantee.

This was a close round but Sky Blue Credit gets the edge.

Who wins round 4 – For Customer Service?

No pressure sales, a straightforward guarantee, and a more personalized customer service

Great online reviews and a low amount of online complaints

They are great on the phones and they respond to emails very quickly

Round 5: Most Informational (Educational) Website

Most Informational Website: Lexington Law

Lexington Law has over 1,100 pages on its website compared to 500 for Sky Blue Credit. Their website boasts some very well-written content articles that are quite in-depth on many different credit repair subjects.

Most Informational Website: Sky Blue Credit

Sky Blue also has a lot of really strong educational information on its website. Being that they are a smaller company, they just simply cannot compete with the content production of their competitor.

Their education center is simple but covers all of the main points about credit repair and how it works.

Thoughts and comments: Lexington Law

Not only is the content really good but it is quite in-depth. Consumers can find answers to many questions on the Lexington Law Credit Repair website.

They provide a lot of information about credit cards, finance, life situations, and recent up-to-date credit news like coronavirus mortgage relief options.

They also have a lot of information about getting loans.

Their top informational pages where they get the most traffic from are; how to calculate an APR, how to fix your credit, what kind of credit do you need to buy a car, how long do judgments stay on your record, information about repossessions being removed from credit reports, getting late payments removed, how to remove a collection from credit report, and how to dispute medical bills among many others.

Thoughts and comments: Sky Blue Credit

Again, Sky Blue Credit really doesn’t come close when it comes to overall education. They have a great website and there’s a lot of great information covered but Lexington Law knocks them down in this category. They are just far superior with their credit education and their ability to commit to always updating and improving that information for their clients.

Lexington Law gets a big vote here for better overall educational website content.

Who wins round 5 – Most informational Website?

They really did write the book on many different subjects about credit repair in their online education center

They have over 1000 informational pages

Their well-written articles that have taken hours to write are extremely informative

So Far, Halfway through this Fight, Sky Blue Credit is Winning 4 Rounds to 1

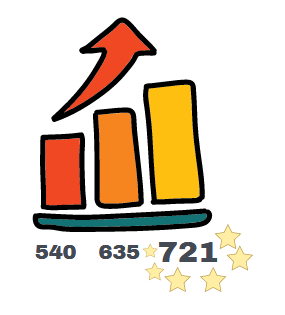

Round 6: Best Results

Best Results: Lexington Law

There is no denying that Lexington Law has been showing results to its clients ever since they opened its doors over 27 years ago. Their lawyers and paralegals have developed tried-and-true techniques to get the job done.

Best Results: Sky Blue Credit

We also know for a fact first-hand that Sky Blue gets the job done from the results that Sky Blue has shown for us. Read our review here of what they have done for us:

Or take a look at the actual deletions that they have realized for us.

Thoughts and comments about Lexington Law and Results:

Since 2004 they have sent out over 183 million disputes on behalf of their clients. In the year 2019 alone, they removed over 1 1/2 million negative items for their clients.

Lexington Law does a lot of volume, so it’s hard to come up with a benchmark of how many deletions they get per client.

Thoughts and comments about Sky Blue Credit and Results:

Sky Blue Credit Repair also shows amazing results for their clients. If you take the time to read some of their online reviews from other sources you will see that they really have a great track record.

Sky Blue gets a big edge here when it comes to price, the value of what you are getting, and the simplicity of the pricing. They have a 4.7-star rating with consumer affairs and a really strong rating with the BBB.

This one is too close to call because both of these trusted firms really do get the job done. Both Lexington Law and Sky Blue have highly trusted names in the industry when it comes to getting the job done for their clients.

This round is a draw.

Who wins round 6 – For Best Overall Results?

Both of these businesses show amazing results for their clients

As pioneers, both businesses have been showing positive results for many years

You could feel confident that no matter which service you choose, you’ll be in good hands

Round 7: Integrity

Integrity: Lexington Law

We believe that Lexington Law is an integral frim. They wouldn’t be in business this long if they weren’t. It only makes sense that being that they do such a large volume they have a higher percentage chance to get more negative reviews.

Integrity: Sky Blue Credit

Sky Blue Credit is one of the top ethical online credit repair companies.

They have been running an honest and ethical business for over 30 years with very few complaints.

They are one of the most branded and trustable names in the industry.

Thoughts and comments:

Trust us, there are many unethical businesses out there. And quite frankly, because of these types of unscrupulous services, the ones that do not run business with genuine honesty, it has tarnished the integrity of the credit repair industry a little bit more than it really should have. It’s unfortunate.

The one small issue with Lexington Law is that because they do so much volume and because a lot of their clients are unrealistic about the results they’re going to receive, or have received, they get bad reviews and overall press on the Internet.

Sky Blue Credit definitely has less bad press on the Internet.

Sky Blue Credit has a great onboarding team that offers free consultations and they have a no-nonsense no pressure sales team.

Unfortunately, because of some (potentially false) allegations by clients, it can tarnish your brand a little bit. We have read some reviews where Lexington Law customers have claimed that the Lexington Law sales team did not represent the program or the expectations of what the client will receive correctly.

We are going to have to give Sky Blue Credit a slight edge here.

Who wins round 7 – Integrity?

Both businesses run their business with integrity

Neither service is out to take advantage of its clients

Both services should be fully trusted. The very very very slight advantage goes to Sky Blue Credit

Round 8: Overall Features

Overall Features: Lexington Law

Lexington Law has come a long way with its technology over the years. They do offer a lot of great features but unfortunately, most of them are add-ons for a higher price.

Overall Features: Sky Blue Credit

Sky Blue Credit has kept its technology clean and fresh and its features simple. The best part is the features that they offer are all included with your plan.

There are no extra add-ons as far as price goes.

Thoughts and comments: Lexington Law

The Lexington Law “Basic” entry-level package (which costs more than Sky Blue’s at $89.85 to Sky Blue’s $79 per month) does not include score analysis, cease-and-desist letters, FICA score tracker, identity protection, inquiry assist report watch or personal-finance tools. You will have to upgrade to the moderate or advanced plans

You would have to upgrade to the moderate or advanced plans to get all of the above which costs $109.95 and $129.95 respectively.

Thoughts and comments: Sky Blue

Sky-blue offers quick and easy online enrollment. Getting started with the program online takes less than three minutes.

Amazing Extras That are Included With Your Monthly Payment

Sky Blue will send goodwill letters, cease-and-desist letters, and debt validation letters at no extra charge for clients that are in their program.

Also included is an in-depth credit score analysis, consultations on how you can rebuild your credit quickly, and if needed debt settlement or debt negotiation consultations.

State of the Art Online Credit Portal

Their online credit portal is also great where users can view the results and interact back and forth easily with the credit professionals that Sky Blue Credit.

Check out the video below to take a look at the Sky Blue online portal.

Who wins round 8 – For Best Overall Features?

Sky Blue has a great robust easy to use online portal

All of their extra features are included in their monthly pricing

There are no hidden upsells or extra plans to upgrade to. Everything is included in one low price

Round 9: Best User Interface (Also Considered is Ease of Use)

Best User Interface: Lexington Law

The Lexington Law website has come a long way over the years. It offers more of a professional corporate look than does the Sky Blue Credit website.

Best User Interface: Sky Blue Credit

The Sky Blue website is designed a lot simpler than the Lexington Law website. They use a lot of white space and icons in the design. The user interface is very simple and easy to use.

It is super clean looking, super intuitive, and very easy to navigate.

Thoughts and comments:

A user interface can be defined by a strong clean design that anticipates what users might need or want to do on a website. How easy is it to surf around the website and facilitate the call to actions? The visual design should be clean, the navigation should be intuitive, and there should be enough white space so that the user intuitively knows their way around the website easily.

The Lexington Law website has gone through many positive upgrades throughout the years and is looking much better than it did. Their website used to be really busy and a little bit difficult to navigate their 1000+ pages.

But they have come a long way and they have cleaned it up very nicely.

In our opinion, as far as the user interface and simplicity, the Sky Blue website boasts an award-winning design.

It doesn’t get any simpler than their website.

They use state-of-the-art icons and a lot of white space. The navigation is simple and easy to use.

We feel their site definitely would convert better as well.

The edge goes to Sky Blue Credit.

Who wins round 9 – Best User Interface?

The super-clean interface is very intuitive and very easy to navigate

You know exactly what to do and where to go on this website

It is a refreshingly simple but effective interface. Award-winning in our opinion

Round 10: Fastest Credit Repair

Fastest Credit Repair: Lexington Law

Lexington Law does not dispute as many negative items per round as does Sky Bue on their lower plans.

Fastest Credit Repair: Sky Blue Credit

As part of this Sky Blue Credit review, we will address how quickly the company can get the job of getting deletions off of their client’s credit reports. Sky Blue Credit seems to be a little bit more motivated than Lexington to get the job done quicker by disputing more items per round per credit bureau.

Sky Blue Credit Tries to dispute in 35-day cycles compared to 45 days cycles that most other companies utilize. The shorter cycles mean that you get more disputes over a shorter period of time.

Thoughts and comments:

They also do not dispute as many items in each round as their competitor.

Sky Blue Credit disputes at least 15 items on every dispute (five disputes per credit bureau)

Most other companies in the industry only dispute two or three items at a time, per credit bureau, per round. Some other companies claim that they dispute even more items than Sky Blue but Sky Blue knows that you have to be careful if you dispute too many items at a time.

Disputing too many items at once looks spammy, and if the credit bureau doesn’t believe in the validity of the dispute it can be deemed frivolous by the credit bureaus and they will not actually research your account.

This means you will not make any forward progress.

Sky Blue Credit Repair gets a big edge when it comes to the speed of getting negative items deleted.

There is still some controversy, however, about how many items to dispute per round. When we spoke with other credit repair experts in the field, the consensus was to not over dispute too many at once but they all agreed that it depends on the situation and how many negative items the client has per agency.

If a client has 30 negative items on one credit report, say on Experian as an example, disputing 5 on the first round would not be an issue. But if the client has say 7 negative items, disputing 5 in the first round may be too much and deemed frivolous. It’s a numbers game. You can always dispute in future rounds so don’t overdo it. Be patient.

It is better to go a little slower and come up with in-depth explanations and valid reasons why the negative items need to be removed instead of just disputing everything at once.

It’s a little bit of a science and both companies are really very good with the algorithms but we feel that Sky Blue is a little bit more attuned with getting the job done in a slightly quicker manner.

Just as a side note, the average client stays in the Sky Blue Credit program for 6 to 8 months. During that time, most if not all, of their clients’ items are cleaned up.

Of course, there is no guarantee of getting a clean slate, and some stubborn items may still remain.

Make sure you use due diligence when choosing a credit repair company.

Who wins round 10 – Fastest Credit Repair?

They simply dispute more items per round

They have shorter turnaround times when they re-dispute. 30 days on average compared to 45 for the rest of the industry

Clients usually don’t need to stay in the program for longer than 6 to 8 months.

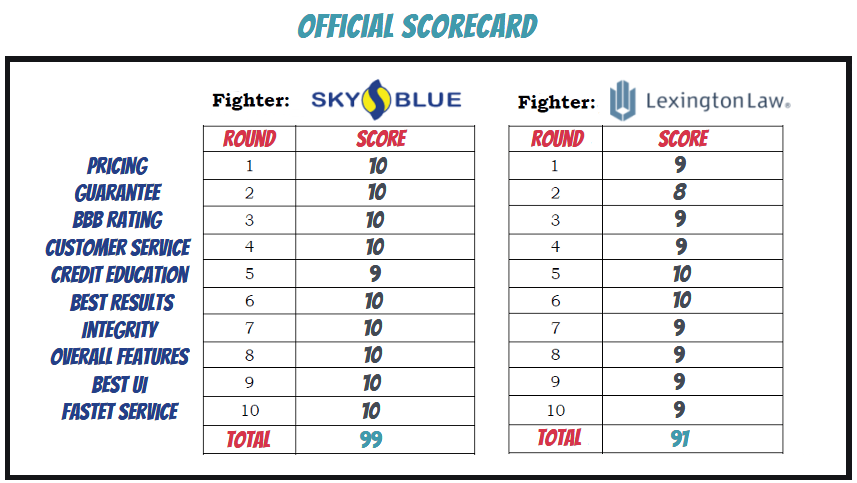

After 10 Rounds of Action! CreditRepairReviews.co scores the bout:

8 rounds to Sky Blue Credit – 1 round to Lexington Law – 1 round Draw

Let’s Go to the Official Scorecards

Overall Winner: Sky Blue Credit Gets the Belt

We hope you enjoyed the bout between Sky Blue vs Lexington Law!

If you have had a chance to try either of these services or if you have your own thoughts, please leave a comment below.

Related Recommended Reading

See our full in-depth review of Sky Blue Credit Repair.

See actual Sky Blue Credit Repair deletions.

Check out Sky Blue Credit Repair BBB reviews and ratings.

See more of our thoughts on the question of Does Sky blue Credit Repair Really Work?

Sky Blue Credit

Sky Blue Credit

Leave A Comment