5 Credit Repair Laws and Legal Credit Loopholes That You Can Use to Your Advantage to Fix Your Credit Fast!

Oh Yeah! This is juicy! Loopholes

This is what you’ve (we’ve) been waiting for.

Loopholes!

Advantages for us to get some real amnesty for once. A real true consumer bailout? Maybe not.

But read on you’re going to love this!

These are the laws and legal credit loopholes that we can all use to our advantage right now to fix our credit.

Here are 3 questions that we will answer fully today!

1. Are there really and truly actual credit repair loopholes?

2. Are there credit repair laws that are on our side?

3. Are there ways for us to legally remove items on our credit reports?

The answer to all three of these questions is yes!

Let’s Start with 5 laws that offer you protection

These laws were created for our protection as consumers. Get to know them well, and you will get to know the loopholes which are actually simply your rights governed by these laws.

Law 1: Fair Credit Reporting Act

The Fair Credit Reporting Act Fair Credit Reporting Act (FCRA) is a United States law mandated by the Federal Trade Commission that regulates the collection, dissemination, and use of consumer information including consumer credit information.

This basically means, there are protections for us as consumers that govern the way that information is collected, shared, used, and sold about us.

The 3 major credit reporting agencies are businesses and they are in the business of collecting information about us and our creditworthiness and selling it to creditors when they are inquiring about our creditworthiness

Think about that

These are essentially third-party companies that know nothing about us. They are gathering our information and selling it.

And at the same time, we don’t know much of anything about them.

Why would we approve of and be at the mercy of someone that knows nothing about us to sell our information to other third parties.

I don’t know about you, but I would be (and am) pretty angry.

I’ll tell you why from a personal experience. Because there been times when there has been erroneous information on my credit reports that I wasn’t aware of and when I applied for a loan that I really needed, I didn’t get it because of that.

You want to talk about being pissed off.

That is one reason that I got into the credit repair industry myself.

The Fair Credit Reporting Act

The Fair Credit Reporting Act requires that all of the data reported on a consumer’s credit report meet three very specific (and very important) criteria.

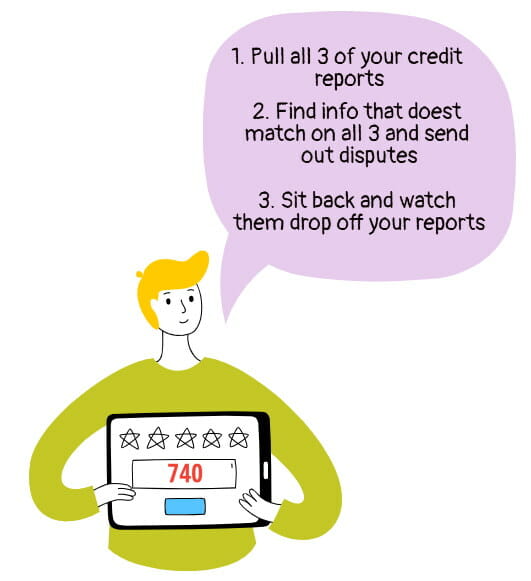

A. By-Law, you are entitled to one free credit report each year from each agency so that you can verify the accuracy of all of the information that is being reported about you.

B. The information that is being reported on a consumer’s credit report must be 100% accurate

According to the law, every single line item above has to be 100% accurate.

And this means everything.

If any of the information (Whatsoever) that being reported about you is inaccurate, the item must be removed from your credit report.

Here is a little bit of the secret sauce

If one of the account numbers that they are reporting about you is wrong, you can dispute it and by law, it would have to be removed.

C. Everything on your credit report must be verifiable whether it’s accurate or inaccurate

This means that whatever you dispute: The items that you have disputed must be proven by the credit reporting agencies and the creditors that your disputes have been 100% verified.

For example:

Let’s say one of your accounts was charged off by a creditor and it is being shown on your credit report as charged-off with a balance that you still owe of $3,750.

If you are not 100% sure about the amount of debt owed, or if you thought it was something else like say $1,800, you can ask the credit agencies to verify and prove the 100% accuracy of that information to you.

You can actually ask them for a statement from the creditor.

Even if the account was yours, that does not mean that it’s 100% accurate.

It is the responsibility of the credit agency to verify any information that you dispute.

If they can’t verify the item(s) in dispute, they must be removed.

Important note 1: The credit bureaus have 30 days to verify your disputes. If they do not verify the information in time and within those 30 days, the information must be removed.

Important note 2: If you apply for credit and a creditor pulls a report and comes back to you and says you have less than perfect credit and they charge you a higher rate, by law, they have to tell you which credit reporting agency that they used, so you can see the actual information that they saw and so that you can verify the accuracy of it.

Important note 3: This is a great one for us consumers. If either the creditors were credit agencies do not want to play ball, or they refuse to verify your information or correct an error that is existing on your credit report, you can sue them to try to recover any damages.

Do you want a little help with the process?

Sky Blue Credit is a great company to reach out to for free consultation if you feel like you need help with the disputing process or to start a claim or suit against one of the three major credit bureaus.

You may be entitled to a $2,500 award should you win

I think the going rate for you getting compensated from a claim with the bureaus is $2500 if you win.

You may also be able to sue for more for your punitive damages and legal fees.

Important note 4: If in their findings, they find that the information about you is accurate, they have to report it to you with the reason why they feel it is accurate within 30 days.

If you still disagree, re-dispute the item and or start a claim and sure them. That will at least show them that you mean business.

D. And lastly, all information must be 100% timely.

This means that the information about you is being reported within the statute which limitations.

There are laws about how long negative items can stay on your credit reports.

In most cases it seven years for negative derogatory items, and 10 years for bankruptcies.

If seven years pass by the last time you had activity on your account, which usually means when was the last time you made a payment on it, the item should be removed.

That is why if you have an old negative item, that is getting close to the statute of limitations, it is a good idea to not make any activity on that account so that it can be legally deleted through the statute of limitations.

The Collection agencies are slick (Heed this warning!)

Let’s summarize the FCRA

Here is a wrap-up of the protection that you get from the Fair Credit Reporting Act.

A. By law, all three credit bureaus are required to provide you with a free credit report once a year.

This gives you the chance to verify how accurate all of the information is being reported about you.

B. As stated earlier if any of the information is inaccurate, you should dispute it immediately, and the credit bureaus must remove that information.

C. The three credit reporting agencies must prove to you that they have tried to verify your disputes within 30 days.

D. Lastly, the FCRA protects you whereas it has a strict procedure for the credit reporting agencies on how long they can keep any negative information on your reports. Again, negative items need to be removed after seven years, and bankruptcies need to be removed after 10 years.

You don’t have to do it on your own

If you would like help from a professional firm.

We highly recommend Sky Blue Credit.

They have over 30 years of experience and they know the laws.

Law 2: Truth in Lending Act (Consumer Credit Protection Act)

The Consumer Credit Protection Act is simply a part of our federal legislation which forces lending institutions to make it 100% clear what the final cost would be when we borrow money.

They must make it 100% clear

The terms and final costs of borrowing money must be in a language that the consumer fully understands.

This helps us as consumers to fully understand the finance charges (and final cost that we need to pay back) that are being imposed on a loan so that we can use due diligence and shop for better rates.

They must fully disclose the cost of the loan, the rate, and the APR in easy to understand manner that is crystal clear to us the consumers.

This puts the kibosh on deceptive or confusing interest rates

All lenders including banks and credit card companies cannot use misleading or deceptive advertising tactics.

The truth in lending act (CCPA) also prohibits discrimination

When lenders look at applicants, they are not allowed to discriminate against them.

Fight back!

The laws are on your side.

They have been put in place to protect us.

You can fight back on your own but if you need representation, and someone to dispute on your behalf, check out the Sky Blue Credit website to learn more.

The cost is just $79 per month and they have a 90-day money-back guarantee.

Law 3: Fair Debt Collection Practices Act

The FDCPA protects us against unscrupulous debt collectors

This protects consumers from ambiguous, distasteful, and downright underhanded debt collection tactics.

It limits the debt collectors to the number of times they can try to contact you, the time of day, and where they try to contact you.

These laws are here to protect you against being harassed. Learn the laws and fight back!

Here is what is not allowed (from debt collectors)

1. Contacting you at your place of business or work to collect a debt.

2. Continuously calling you over and over.

3. Threating you in any fashion. Sometimes they will threaten to impound your car if you do not make a payment right now as an example.

4. Calling too early, before 8 am, or calling you too late past 9 PM is prohibited.

5. Intimidating you or frightening you that they will report negative information to the credit agencies.

6. Talking or negotiating with anybody but you about your alleged debt.

7. Embarrassing you whether in public, on the telephone, or via mail.

8. Lying about who they are in any way.

9. They are not to contact you if you have requested validation of the debt.

10. They are not allowed to contact you if you have an attorney.

11. They cannot disrespect you in any way. That means they cannot raise their voice, talk down to you, or use foul language when speaking with you.

12. They cannot threaten that they are law enforcement, deputies, or lawyers.

13. Ask for more than you really owe.

They must stop contacting you if you write them a letter telling them to do so

Simply write a letter stating that you are requesting (ordering them) to cease contacting you and that you will under no circumstances pay the bill.

What to do if a collector does not comply with the FDCPA laws

You can sue them

You can hire Sky Blue Credit to dispute and file on your behalf.

If you win, you can be rewarded for damages and fees. The debt collector will have to pay you $1000 plus representation fees.

You can also file a complaint with the Consumer Financial Protection Bureau.

Other thoughts:

Remember that even if the debt is rightfully and knowingly yours, according to the FDCPA laws, the creditors must abide by the aforementioned laws.

Disclaimer:

Because laws change all of the time, CreditRepairReviews will not be liable for any incorrect or misleading information. Please contact an attorney to get a full understanding of the laws, how they affect your situation, and your rights by these laws.

Law 4: Fair Credit Billing Act

Simply put, this law protects us against biased, dishonest, or illegal billing practices from creditors.

It gives us the right to dispute charges that we do not agree with.

You have 60 days (from when you receive your bill) to dispute a charge.

What you can dispute

1. An item or service that you feel you did not purchase.

2. You never received the product or service from the merchant.

3. The products came to you damaged.

4. The products you ordered were not delivered in a timely manner as promised.

3. You never received a statement from the supplier or creditor.

4. The amount charged was not consistent with what you thought you were paying.

What to do if a creditor does not comply with the FCBA

Send a registered letter (overnight it if possible) to them stating your case with the reasons that you are disputing. (You can sometimes also file a dispute online).

Wait for the creditor to respond. They have 90 days to investigate the dispute. They must respond within 90 days with their decision.

If they decide in your favor

Done! You’ve won!

If they decide against your dispute

You should respond by asking them to verify their findings with proof.

If they do not respond or you are unsatisfied, you can file a lawsuit.

Law 5: The Equal Credit Opportunity Act

The ECOA forbids prejudice by lenders and creditors when scrutinizing loan applications.

Here is what they cannot discriminate against

1. Your sex

2. Your age

3. Your race

4. Your creed

5. Your color

6. Your religion

When creditors make credit worthiness conclusions, they cannot discriminate for the aforementioned reasons.

Getting Help

If you feel your rights have been violated or you just simply would like a free consultation on how you should approach your situation, you can contact Sky Blue Credit for advice.

Should you become a client, you can be confident in that they offer a full 90-day money-back guarantee

They are also rated very high with the BBB. See the Sky Blue Credit Repair BBB ratings and reviews.

Take a moment to check the Sky Blue website.

Getting Help from the Consumer Financial Bureau

You can have your complaints reviewed by submitting a complaint with the Consumer Financial Protection Bureau.

Please leave feedback or questions below.

We would love to help you with any questions!

Leave A Comment