United Financial Freedom Reviews | Can a Money Max Account Help to Pay off a Mortgage Early & Help You Get Out of Debt Fast Without Changing Your Current Salary? Is It Possible?

Can a Money Max Account help you to pay off your mortgage and other debts in as little as 5 to 7 years without you making extra money?

In a word. Yes

The Money Max Account is an astonishing debt payoff planner, tracker, and debt elimination software that really works!

This is a very exciting offer.

How do we know that it works?

Because we are a client and are already seeing the results!

And we are going to show you the results.

You are going to love this!

But before we dig in, let’s briefly define what Financial Freedom actually is.

What is the True Definition of Financial Freedom?

United Financial Freedom Has Revolutionized a Debt Payoff Planner That Makes Getting Rid of Debt a Mathematical Certainty

When you use the Money Max Account software you do not have to do any math and you can pay down your debt quickly making the same exact amount of money.

United Financial Freedom is a professional financial company that offers their proprietary Money Max Account software that uses and leverages mathematical algorithms and strategies to get you out of debt WITH LITTLE or NO CHANGE to your current lifestyle.

You simply plug in your information and let the software do its magic by analyzing your finances and giving you your very own DEBT FREE DATE by utilizing its tried-and-true done-for-you mathematical formula.

You, Will, Get Out of Debt in The Fastest Time Possible

Their software program shows you the consumer. the absolute fastest way to get these debts paid down simply using that powerful logic of math.

The magic of having a mathematical formula is that it automatically updates your situation when you enter data into the program and it completely removes the possibility of failure.

That is if you follow the formula.

United Financial Freedom offers software called the Money Max Account that calculates all the different debts that you have, the amount owed, interest rates, the billing cycle date, and many other variables that are associated with each debt.

The software then mathematically determines exactly which debt to target, the exact time frame to target it, and how much to target that debt with an exact amount that you should pay towards that particular debt.

It comes down to one thing. The math.

The math will give you your debt-free date!

What Will Your Debt-Free Date Be?

Get a FREE analysis of how long it will take to become debt-free!

Get your FREE Debt Payoff Date Analysis today.

You can find out right now!

It’s 100% free and you do not need a credit card to find out your debt-free date!

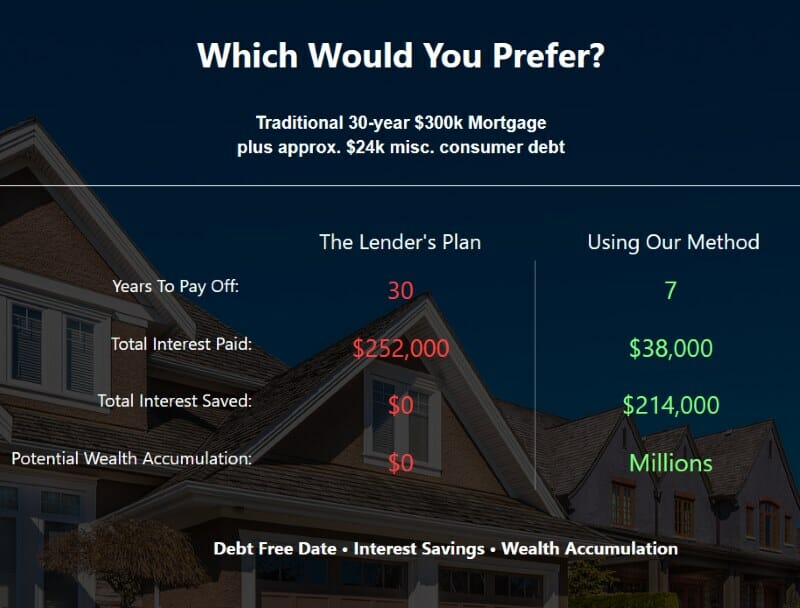

The banks are Making Money off of You From Interest

The banks have a different strategy for how long they hope that you pay down these debts. And if you pay down your mortgage and credit cards the traditional way, like most Americans do, you will be in debt for 30+ years.

In many cases much longer. Most Americans never get out of debt.

It’s Your Turn to Turn the Tables on the Banks

Now is the time to take action and take advantage of an opportunity to finally get out of debt FOREVER.

By utilizing the United Financial Freedom Money Max Account most consumers can pay down their mortgage and all other debt on average between 3 and 10 years.

The Money Max Account software aggregates all of the information into its algorithm and then gives you an exact scientific plan for you to get out of debt in the least amount of time possible.

By utilizing the software and its proprietary mathematical algorithm, it takes the guesswork completely out of the equation.

The Software uses algorithms and state-of-the-art advanced banking strategies that comes up with and determines a mathematical master plan that helps pinpoint and identify the quickest and most effective financial strategy to not only pay down your debt as fast as possible but also to help you build up cash assets in your bank account.

Here is a Closer Look at How Amazing The Software Truly Is!

The Algorithms Update on the Fly

When you make more money the algorithm recalculates all the variables, when you spend more money the algorithm recalculates all of the variables.

The software constantly looks at your cash flow and the debt that you have on all of the accounts that you have to pay, total monthly expenses and it figures out the best way to maximize what to do using the rules of the accounts that you have, and the rules of the bank so that you are canceling out as much interest is mathematically possible.

You Get Out Of Debt and Build Wealth Simultaneously

It is essentially giving you the formula to get out of debt as fast as possible while also showing you how to build wealth at the same exact time.

The software gives you a fully executable and 100% actionable action plan.

All you have to do is input and let the software know exactly what you’re spending and what you are making and simply follow the steps.

It Starts to Get Exciting Fast!

Once you get involved with the software and feel more comfortable using it, and you start seeing the results, that is when things really start to get exciting.

You will see your debts dropping and your years to pay off the debt declining!

You will actually come to enjoy using software excited to stay on track and to really get it done! Getting out of debt that is.

You don’t have to worry about crunching numbers every month. Just simply follow the steps.

When the software dictates that you should pay a bill you simply pay it. After you have paid the bill, you can go inside the software and just click on a button that says that the payment was executed.

It’s truly that simple!

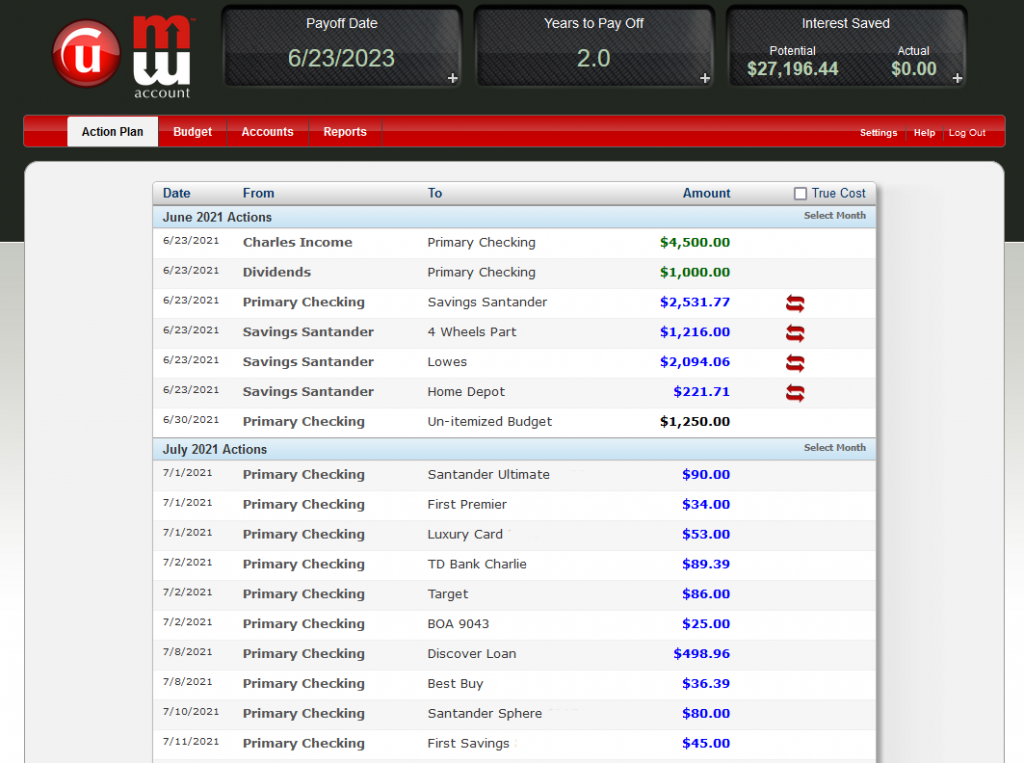

Advanced Metrics in the Software

This is my personal Money Max Account. As you can see my payoff date is June 23, 2023, in the amount of interest that I will save is over $27,000.

Advanced Action Plan Tasks

One thing that we found fascinating with software that you just simply cannot do on spreadsheets is that it gives you notifications where you’re going to do something a little bit out of the ordinary.

For example, it will tell you to move an exact amount of money from one account to another account. It could be because of the advantages of the interest rates in the other account or could be for a number of variables. But the point here is that it’s going to make every single penny count.

The algorithms use advanced rules to know the direct correlation between your cash flow, the types of accounts that you have, the interest rates, and how far along you are along with getting each debt paid down.

It maximizes everything under one roof and bundles everything in an easily presented manner so that it effectively cancels out as much interest as possible and the fastest amount of time mathematically possible to get you out of debt as quickly as possible.

But We Haven’t Gotten to the Best Part

There is something that makes this software and tools something way better than just a debt payoff tool.

It is super dynamic, it adjusts on the fly, and it gives you amazing insight into different scenarios in your current life situation.

For example: Imagine that you want to go on a vacation you want to allocate $5,500 toward it. You simply plug it into the software before you even go on vacation and the software will tell you how it’s going to affect your payoff plan and ultimate payoff date.

The software recalculates everything and gives you a Birdseye view of exactly what your new payoff date will be.

You can then see if that action plan that you are considering makes sense or not.

To add a vacation within the software, you simply go to the add new action tab and add to vacation as a withdrawal, and plug-in the credit card that you’re going to use to purchase a vacation.

Most consumers do not plan their scenarios. Most consumers will put the vacation on a credit card and hope to pay it back eventually.

With the software, it gives you a 100% mathematically realistic view of exactly how much that vacation will cost you.

There is Another Great Feature Called True Cost

Let’s say you need to use $10,000, to remodel your kitchen. The software will tell you how much that $10,000 will actually cost by taking into effect the interest rate on that card as well as other debts and of course the amount of your income.

So just for demonstration purposes, it might say that $10,000 will eventually actually cost you $26,500 by paying it off over time with interest. You will then have a more solid foundation for you to make a decision on whether or not you should remodel your kitchen at this point or not.

The great part about the software is that you can plug scenarios into it and see if they make sense.

You can use it to put in the proposition of buying a new car, how much the car will cost, how long the term will be on the loan, the interest rate, your down payment, and the software will figure out your fully amortized monthly payment.

If you get a new credit with say a $10,000 credit limit with a one-year introductory 0% interest rate, you can plug that into the software and it will tell you exactly which cards to transfer the balances from onto the new card.

The software also works amazingly well you if you are getting involved with making investments

For example: If you flip properties or buy properties and rent them, you put all that information into the software.

The software will then tell you how much time you have for you have to get the place rented.

And let’s say after you get it rented you’re making a profit that added money and into your payoff plan and you will see in real-time your new scenario how long it will take you to be completely debt-free.

The software is absolutely amazing for showing the cause and effect of every financial decision that you will ever have to make either today or 10 years in the future.

It’s time to beat the bank at their own game.

Let the software algorithms outsmart the banks.

Instead of paying your mortgage and debts often 30 years, you can now come up with a plan to do it in around five years on average.

Pricing

Pricing ranges from $1,000 up to $3,500 depending on your situation.

Getting a Debt Analysis is 100% free.

The Debt analysis will show you your DEBT FREE DATE.

There is no obligation whatsoever.

You Get Full Unlimited Lifetime Use of the Software

Use the software for as long as you like. Essentially, own the software forever.

Unlimited use of your Money Max Account is perfect for making investments for when you are finally out of debt.

You can then use the software with your investments and you can start building wealth!

How Does United Financial Freedom Stack up Against its Competitors?

There are a couple of other very popular non-software-based variations of strategies from renowned financial advisor professionals on how to get out of debt as quickly as possible. By using their strategies, they claim that you can get completely out of debt anywhere from 2 to 10 years while making the same amount of money.

One of the most popular is Dave Ramsey’s system. The idea is simple in theory.

Widely known as the Debt Snowball Method.

Simply take all of your debts and put them in a spreadsheet with the lowest amounts owed on top. Then, you simply start paying down the lowest balances first.

To do this, you would pay the minimum payment on the higher balances you can get just enough money to pay off that first lowest balance.

In theory, when you pay off that first lowest balance, you are on your way to getting out of debt quickly.

Being that there is a zero balance on that one debt, you will allocate that money to the next debt in line (on your spreadsheet) with the lowest balance.

Please note that when using a formula like this and giving it the optimal chance to work, you must not incur new debt. The first balance that you paid off must remain at zero.

Suze Orman’s strategy is very similar in theory. But with her suggestions, she is tackling the debt from the opposite direction.

She suggests putting all of your debts in order to spreadsheet again, but this time put the highest interest rate credit cards on top.

These are the ones that are costing you the most money right now.

Suze Orman’s is just too complicated

So with her theory, if you get the first card paid off at the highest interest rate, you can allocate that monthly payment to the next debt with the highest interest rate. In her Road to Wealth formula, there mention (to the complicated effect of) doing a bunch of math on your own by figuring out the largest amount you can afford toward all of your balances and paying an extra $10 above the minimum payment that the card is asking for, Then adding up all minimum payments balances, including the extra $10 for each card and if the difference is greater than what you could initially afford, you apply that difference to the highest interest rate card.

I don’t get it. And it’s complicated.

A better solution is a Money Max Account. Because it’s your personal GPS to achieving freedom from debt.

Do These Other Systems Work?

Both of these systems are ideas that absolutely could work to help eliminate your debt.

But they are not as turn-key and they involve a lot more work and math on your side.

Both Dave Ramsey’s and Susie Orman’s strategies may work but which one you choose depends on your financial situation, how higher balances on your high-interest rate credit cards, what your overall available credit limits are many other factors.

Dave’s could take longer and cost you way more money in the long run.

Again, as long as you’re not incurring new debt and using your cards as you are doing your pay downs in their suggested systematic order both strategies will definitely work.

But you have to do all of the math.

The easy solution is yo have the math done for you with a Money Max Account.

When you are considering using any kind of strategy, system, or software to help you get out of debt in a short amount of time, you have to understand that you must be extremely proactive and diligent in managing your finances to make it happen. You have to make payments in a timely manner and you might have to shift money from account to account as well as carry out other timely actionable tasks. Just remember that whether using either spreadsheets or software, most systems are not reactive solutions. They are all actually proactive solutions.

What If I Run Into An Emergency or More Debt?

Life happens and emergencies will surely happen.

Do not worry about it. If you need to use a credit card, use it!

The system will re-track everything and recalculate for you.

You’ll be back on track before you know it!

Things to be Mindful of When Using the Software

Here are a few tips to get the most out of the software

Our Final Thoughts

United Financial Freedom has been helping consumers to become debt-free for many years.

The customer service team and the way they hold your hand and help you along the way are outstanding.

The Money Max Account Software truly is revolutionary.

This is one product that we fully endorse where consumers can pay off their mortgages and other debts in as little as 5 to 7 years on average if they use due diligence and use the software correctly and work hard at the goal of becoming debt-free.

Leave A Comment