How to Get 800 Credit Score (In the Shortest Amount of Time) | Tip# 6 includes the secret sauce!

So you want to be a rockstar with your score?

Or maybe you need to get a higher score than what you have now and you want to do it as quickly as possible.

Either way…

We’ve got answers for you.

Just to be clear, when we are talking about credit scores we are referring to your FICO score.

Before you read this post, you may want to see our other related post of 13 clever ways on how to raise your credit score fast.

Getting an 800 Fico score is not easy if you don’t have a long credit history.

But it can still be done.

Getting an 800 FICO score is also not easy if you have some blemishes (negative items) on your credit report.

But can help with that too!

First, were going to go over some of the basic necessities that you need to have a high Fico Score:

You probably know these but let’s run through them quickly anyway.

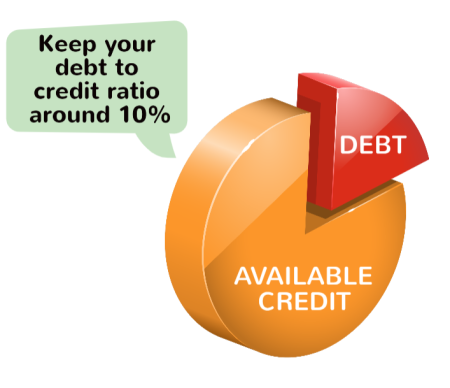

1. Have a low amount of debt (debt to credit ratio)

They look at how much available credit you have and how much debt you have.

You want to keep your debt to credit ratio ideally under 30%.

Example:

To keep it simple let’s say you have 3 credit cards. Your available credit on one of the cards is $5,000. Your available credit on the 2nd card is $2,500. And your available credit on the 3rd cards $2,500.

In this scenario, you have $10,000 worth of available credit.

Let’s say you have balances on all 3 credit cards in your balances that add up to $2600.

You would then have a 26% debt to credit ratio.

Again, anything under 30% is considered good.

But if you want to raise your credit score quickly, and get to that 800 mark that we are striving for, you want to get your debt to credit ratio to 10% or below.

So in the scenario, you would want to get your balances from $2600 down to below $1000.

Solution: Pay down your debt.

– Get someone in your family to lend you money.

– Get a second job and be devoted to paying down your debt to credit ratio below 10%

2. Have a low debt to income ratio

Increase your income | Lower your debt

A consumer’s debt to income ratio is calculated by taking all of their monthly debt payments (credit cards, rent, mortgage, loans, etc.) and dividing them by your monthly income.

They actually look at your monthly gross income before taxes.

The reason this is important, from a creditor’s point of view, is because they want to see if you make enough money to make all of your monthly payments.

Example: If your mortgage is $2000 a month, and you have 5 credit cards with balances that you are paying $500 a month to, and a car loan for $300 a month, and a personal loan that you are paying $200 a month.

Your total monthly debt payments would be $3000 a month.

If your gross monthly income is $6000 a month your debt to income ratio would be 50%

If your gross monthly income is $9000 a month, your debt to income ratio would be 33%

Does that make sense?

Good.

What is a good debt to income ratio?

Anything around 25% is really good.

If your debt to income ratio is between 15% and 20%, (or lower) that is considered excellent.

The benchmark that lenders look at is 36%. Ideally, you want to be below 36%.

Anything over 50%, and you’re going to have a hard time getting a loan.

And you’re certainly not to be anywhere near an 800 FICO score.

Solution:

– Figure out a way to show more income. If you do get a 2nd job as proposed in the 1st step that would help.

– Add your spouse or family member’s income to yours and make sure to update the newer higher income with each creditor. You can usually do this online.

– Beef up your monthly income on your own and hope they do not do a verification. Simply sign in to your creditor account online and change your salary. Sometimes they might ask you to send them pay stubs to verify your income. That is a rare occurrence, however.

3. Remove any Baddies off of your credit reports

This is absolutely one of the quickest ways to raise your score.

So how to get the baddies removed?

You dispute them with the credit bureaus.

This is pretty simple and you can do it yourself.

Simply pull all three of your credit reports and look for any inaccurate information.

Also asked them to prove that everything on the credit report is actually yours.

It is your right by the law to have them prove that everything is actually yours and that everything is 100% correct.

You can also hire a credit repair company to help you with this.

See our list of trusted credit repair companies that will get the job done for you.

Remember what we are trying to do here: and that is to get our score to 800!

Solution:

– Dispute any erroneous information or negative information with the three credit bureaus and get the negative items removed.

– Here’s a great tip that sometimes actually really works with late payments that are appearing on your credit report. Call the creditor and tell them that you ran into a few issues and ask them if they can remove the blemish. In a worst-case scenario if you have a charge-off or something like that, try to make a deal with them and ask them if you make a payment or get it up to date will they remove the negative item on your credit report. You’ll never know unless you ask.

4. Slow down on spending (using your credit cards)

Stop using your credit cards.

Solution: Make believe your credit card is a debit card. If you don’t have enough money in your bank to cover, do not use it.

5. Don’t be late paying your credit cards

This one is very important because recent late payments can really hurt your score.

Solution:

– Set up automatic payments.

– Be on top of it if you are not setting up automatic payments and make sure you pay them on time

Make sure that you make all of your payments on time. A good way to get organized is to put all of your creditors and payments into a spreadsheet in the date order that there due. Look at the spreadsheet every day and keep track of your payments in the spreadsheet.

6. Get more available credit (Secret Sauce is Right Here)

Try to pick up a few more credit cards so that you’ll get more available credit, which will lower your debt to credit ratio, which will raise your score immediately.

Some Secret Sauce Right Here

Get added as an authorized user to the credit cards of your family spouse, partner, or friends.

Ask them to do you a favor, and add you to one or two of their high credit limit cards. They don’t even have to give you the card. They can keep it in a drawer.

Of course, make sure the cards that they are adding you to, have higher credit limits with lower (or even better yet no) balances.

This can be a very effective technique for getting a higher credit score very quickly. If you get an extra 50,000 available credit to you, through the use of your friends and family you’re golden.

You can also look online for companies that offer trade lines. These companies will add you as an authorized user but you’ll have to pay for it.

But hey you wanted an 800 FICO score, didn’t you?

We just told you how to do it. And we didn’t charge you! :)

Learn more about how piggybacking credit works.

Solution:

– Ask friends, co-workers, your spouse, lovers, family, your children, your neighbor, anyone, to have them add you as an authorized user to their accounts.

– Call your creditors and asked them to raise your credit limits. If they do that’ll give you instant available credit.

Need help or do you want to expedite the process of raising your score? Try Sky Blue!

Make sure that after you read this blog post in its entirety that you check out this other blog post on how to raise your credit score fast.

There are a lot more tips and secret sauce for you to get your score over 800.

7. Do not inquire for new credit on your own unless you are pretty sure you’ll get approved

This one is a little bit tricky because sometimes it works and sometimes it backfires.

If you have decent credit already, you are pretty sure that you will get a new credit then it is worth the risk to try because you get an instant boost on your debt to credit ratio.

And this light hit in your score from the inquiry won’t hurt you.

But conversely, if you try to get a couple of credit cards and you do not get approved, your only getting slapped with inquiries which will lower your score.

8. Diversify your credit portfolio by opening different account types

This is again, as mentioned in point 7, really only a good strategy if you have decent credit already.

Your Fico Score uses algorithms that look at the different types of creditor accounts that you have.

If you only have say department store cards that will have a negative impact on your score.

If you have a strong diversity of different types of accounts, it will improve your score.

If you have a good mix of department store cards, bank credit cards, lines of credit, mortgages, auto, and personal loans.

A good tip to improve your score is to get an auto loan you don’t have one and pay it off as quickly as possible.

Paying off loans will improve your score.

9. Try to pay your credit cards in full on each billing cycle

The first thing you should try to figure out is when does your billing cycle change on each card.

This will help you to manage and control your spending a little bit.

Simply try to pay off the entire balance each billing cycle a few days before the billing cycle ends.

10. Never close old accounts

This leads to point 10 below.

Your older cards are helping you to build a credit history.

Even if you’re not using the card just leave the account open. Make sure that use that older card once in a while so that the creditor does not close the account on you. If you don’t use your card for years they will close it on you and you don’t want that to happen.

A big factor in your score is the amount of length of time that you have had credit available to you.

Closing an older card (or multiple cards) believe it or not can devastate your score.

10. Continue to build your credit history

The longer the credit history that you have, the easier it is to get your score to 800.

Adding yourself as authorized users to all their accounts can help this metric.

Continuing to pay your cards on time, and getting any negative items removed will also slowly raise your score.

Time is on your side as you age and continue to manage your credit responsibly.

11. Bonus Tips Utilize balance transfers and or debt consolidation offers

These are a little bit more of advanced strategies, but they can help you on your way to an 800 FICO score.

These strategies are especially useful if you are carrying balances that are difficult to control.

Balance Transfers:

Balance transfers can be extremely useful where you can move balances with a high-interest rate from one card to another card with little or no interest.

The first thing it does is cut off the bleeding, or what we call “the juice” in the industry, or in layman’s terms the high interest from continuing to accrue.

If you move a balance with high interest to no interest, it gives you a chance to catch up and pay off that debt.

It will not necessarily raise your score initially, but it will when you get that debt more in control or if you eliminate that that on that card.

Consolidating Debt:

Consolidating your debt is a great strategy if you have more than a couple of cards with balances on them.

The first thing it accomplishes is putting all of your balances into one lump sum, where you can make one installment payment.

This helps you say you not have to make multiple payments to different creditors.

This will also help you tremendously also helps you if you get a good interest rate or at least a rate that is lower than what you are currently paying on your debt balance.

Consolidating your debt, believe it or not, will actually help raise your score.

It may not help right away but as soon as you start making some payments you should see your score go up.

The reason that your score goes up is because you have wiped out the balances on your other cards (that you transferred the balances away from) it helps the debt to credit ratio instantly.

Closing Thoughts

If you do not have the time to work on all of these strategies, you could hire a professional credit repair company to do some of these things for you.

You can at least have them start working on the task of cleaning up your credit reports and getting any negative items removed.

See our list of trusted credit repair companies that will get the job done for you.

There is some more good reading if you follow these links!

[ how to raise your credit score fast | piggybacking credit | benefits of having good credit ]

Leave A Comment