How Do I Effectively Write a Credit Dispute Letter For the Credit Bureaus

Okay, if you are here, you are probably aware that you have the ability to create your own dispute letter to dispute any erroneous or negative information on your credit file with the three major credit bureaus.

That’s good.

You are one step ahead of the many consumers that do not realize that they have this ability or the true right to actually demand that the information on your credit reports is 100% accurate.

You are just not completely sure how to execute the letter to maximize your results.

We can help you with that!

But before we start, let’s understand why you have the 100% right to write and send a letter to the credit agencies in the first place.

The Fair Credit Reporting Act is on Your Side

Ever since the Fair Credit Reporting Act was passed in 1970, consumers have been able to dispute negative items on their credit reports.

The Act was passed to protect consumers.

It was passed to ensure the accuracy of your information that is being reported on your credit reports.

Because the three major credit bureaus actually sell your information to banks and creditors, the Fair Credit Reporting Act helps and protect consumers to make sure that the information that they are given to third parties is 100% accurate,

So your first step in the dispute process is to pull all three of your credit reports from the major credit agencies and scour them for any outdated, or erroneous information that is being reported about you.

When you find information that you feel is inaccurate, you simply write a letter and send it to the credit bureaus.

As long as the credit disputes are legitimate, the credit reporting agencies are required to investigate your disputes and they are required to remove any negative or misleading items from your credit report if they cannot verify the accuracy.

What is a legitimate dispute?

If you write it down and send it.

It is legitimate.

No matter what you are writing about or what you are disputing.

It is your right to dispute anything you want and for whatever reason.

If there is anything whatsoever that is not 100% accurate on your credit report, again, according to the Fair Credit Reporting Act, that information must be removed.

Period!

I repeat. The information MUST be removed.

So let’s get right into it.

And let’s certainly not overthink it.

You simply need to write a dispute letter to the three major credit bureaus:

All you need to do is ask them to verify who you are and verify that all of the accounts and information that they’re reporting about you are 1 million% accurate.

Again, remember, according to the Fair Credit Reporting Act, all information that is being reported about you must be 100% accurate or it must be updated or it must be removed.

This works for anything on your credit report.

Here are some examples of what can be updated

If your address is not reported correctly, it must be corrected.

If your date of birth is incorrect, it must be corrected.

But those are small fish.

Let’s talk about a bigger fish to fry.

Here is an example of getting a stubborn item removed

Let’s say that you had a bankruptcy. And let’s say that it really was a true bankruptcy.

And as a quick side note here, having a bankruptcy really sucks. And we feel for you. We have all been there.

Or we have many constituents that we know that have been there.

But back to our point.

You can dispute that bankruptcy.

You can ask the credit agencies to prove that that bankruptcy was yours.

That is your right by the law, from the Fair Credit Reporting Act.

If the credit bureau comes back in their response to you and says that the bankruptcy was actually yours and that they will not remove it, you can dispute that bankruptcy for other reasons.

So you can kind of just wash rinse and repeat with different disputes.

Some disputing ideas

Ask them to validate the actual date of the bankruptcy.

Asked them to provide written proof that you actually filed for bankruptcy.

If they still do come back and verify that the bankruptcy was yours, you can look at another angle (like disputing the statue limitations) and potentially re-dispute it again.

For example:

If you have a bankruptcy listed in your credit report that is over ten years old, (10 years is the statute of limitation for bankruptcy, seven years is for most all other derogatory items) you should write a credit dispute letter, asking the credit reporting agency to remove the item.

It’s all about knowing what to dispute and then how to effectively write a credit dispute letter that will yield results.

Getting Your Credit Reports For Free

Before drafting your credit dispute letter, you should request a copy of your credit report so you know what to dispute.

You’re entitled to one free credit report each year.

This can be achieved by going to sites like www.annualcreditreport.com or www.freecreditreport.com.

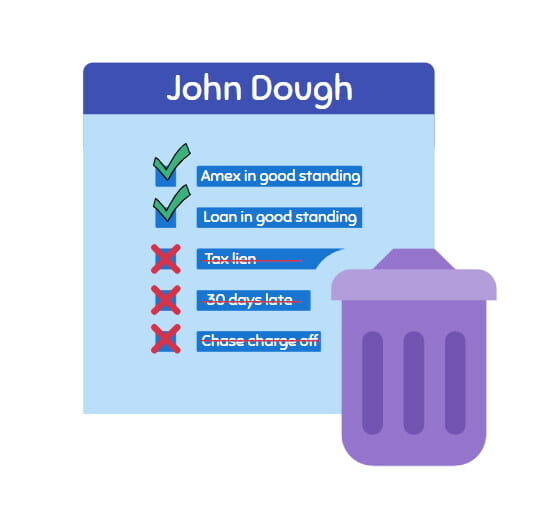

Once you receive your credit reports from all three credit bureaus (Experian, Equifax, and TransUnion), make sure you take the time to go through each and every creditor account and make a complete list of all disputable items.

Then comes the hard part:

Or is it?

No, it’s not hard, it’s actually very easy!

Here are your two choices

1. A credit dispute letter must be professionally written.

2. Or a very ridiculously poorly written credit repair dispute letter must be written.

Sounds like you’re contradicting ourselves right?

Actually we are not.

If a really professionally written credit repair dispute letter is written, and it challenges the credit agencies with some sort of precedents of the law and/or your rights as a consumer, your chances of getting the erroneous items deleted are extremely high.

If it’s very professionally written but looks like a cookie-cutter template the credit repair agencies will counter respond as a frivolous dispute request and they will likely take no action.

So it’s sort of are very fine line.

If it is poorly written, it is not a bad thing either, because it looks like it’s coming from a real person. If the handwriting is shaky and there are some misspellings, and verbs are conjugated correctly, it could look like a real person wrote it.

We’re not telling you to write your dispute letter with your left hand in crayon, we are just suggesting that you make sure your letter looks genuine somehow.

The three credit agencies are not stupid and they will know when you are making frivolous disputes.

They will also know when you are using computerized templates.

If they see any sort of red flags of automation, they will make their stand and deem your dispute as frivolous.

So now that we know that the credit agencies are actually very hip to this, we can make our adjustments and write the perfect dispute letter!

Let’s just make sure we stay one step ahead of these small formalities. :)

And your disputes will be rewarded!

So what kind of wording should I use?

It helps when you use strong words like erroneous, outdated, misleading, or unverifiable.

Here are some phrases. Try to make unique variations of these.

“This account is not mine.”

“I don’t recognize this account.”

“This was not my account.”

“My entire credit report is outdated.”

“I have never had that credit card.”

“I don’t know what this account is.”

“This information is inaccurate and misleading.”

“I feel that this account is unverifiable. I have no memory of it.”

Be as specific as you can

It is a good idea to dedicate as much time as you can to explain with good reason, each credit dispute in your letter, as it will give you a better chance of the Bureau not deeming your dispute as frivolous.

The more supporting evidence that you send, the better your chances are to have our items removed from your credit report.

Go into a semi-lengthy description when explaining your side of the story.

Make it is as juicy as possible.

Here are some examples of being a little more specific on a dispute

“That is not the correct balance that is being reported on the charge-off on my credit report. I actually have no balance. I called the creditor and I made a deal with them that if I pay off the balance, they would report the balance is zero on my credit report and they would place my status in good standing”.

“Please send me a signed copy of the actual application for this loan. I never received this loan. This loan is definitely not mine. Please remove it from my credit report as soon as possible.”

The more you include, the higher the chance of success

If you have real reasons and real scenarios, make sure to use them. Again, use as much supporting evidence as you can to state your case. Be as thorough as possible. Include account numbers and specific reasons as to why you are disputing.

Don’t forget to include personal information such as your name, address, and social security number. Include the account name and number you are disputing, as well as supporting documents like paid receipts.

Most importantly, you should include a copy of your driver’s license, a copy of a banking statement and a recent bill showing your current address.

Lastly, make sure you include a copy of your credit report with the credit dispute letter.

State your case in a very matter-of-factly way

Be specific about what you are disputing about.

Make your credit disputes fully personalized

Credit dispute letters should be personalized.

Try to write a letter like you are a real person. If you send a computerized version or template type version the credit agencies will deem it as frivolous.

Handwritten credit dispute letters are always more effective than ones that are typed out.

Make sure you write a separate credit dispute letter for each credit dispute.

Start with the credit dispute that is most harmful to your credit. A charge-off account is much more detrimental to your credit than delinquency on your credit card.

Send your letters via certified mail

Finally, you must send the credit dispute letter via certified mail.

Certified letters can cost between $5.00 and $10.00.

Dispute with all three of the credit bureaus

Also, it’s important that you address all three credit bureaus, even if only one or two credit reports contain the credit disputes.

Waiting for results

It normally takes between two weeks up to a month to receive a reply from the credit reporting agency, confirming that the credit dispute letter has been received and that the dispute is under investigation.

After another two to four weeks, you should receive an updated credit report with the credit dispute removed.

Remember the law is on your side. It is your 100% right to dispute items on your credit reports.

Unless the credit reporting agency can provide stringent proof that the negative item is legitimate, it must be removed from your credit report.

If you do not get the results you wanted: Simply re-dispute

One loophole in the system is that the credit agencies get bombarded with many different dispute letters at once. These end up sitting on top of someone’s desk and they do not get around to actually handling your dispute.

If this happens and they do not have the time to review and investigate your dispute, according to the Fair Credit Reporting Act, the items must be removed.

Is this 1000% ethical? Probably not, if the items that you are disputing, are knowingly correct on your part.

But if you are not 1000% sure of the validity of the accounts or information being reported about you, you should absolutely ask them to verify it.

And if it sits on someone’s desk over 30 days and they cannot verify the information. it must be removed.

A loophole is still a loophole.

It’s paperwork and it’s red tape.

Do not have the time or the know-how?

The process of writing credit dispute letters can be daunting, to say the least, which is why Sky Blue Credit Repair (Our #1 choice for the best credit repair company) is willing to do all of the work for you.

Let the pros write the letters for you. Try Sky Blue!

With their personalized credit repair service, they will evaluate your credit reports and tailor each credit dispute for you. They also have advanced tried and true strategies that get results quicker.

Knowing the ins and outs will avoid getting stall letters from the credit agencies as well as them deeming your dispute as frivolous.

Believe us, the credit bureaus know who is sending in templated frivolous letters.

Unlike other credit repair companies, Sky Blue does not use computerized, automated credit dispute letters.

And neither should you if you want to go at it on your own.

Sample dispute letters

Well here we are finally, and this the main reason why you are here.

Because you were wondering

“How Do I Write a Credit Dispute Letter For the Credit Bureaus?”

Below are some sample dispute letters.

Don’t copy them verbatim. Try to make them your own.

Remember, make them personalized, informative, unique, situational, and as descriptive as you can.

In other words, state your case!

Sample Credit Dispute Letter

Make sure to make it personalized and give as much factual evidence as you can.

Mouse over the box below to see a sample dispute letter.

A Sample Dispute Letter

Sample Experian Dispute Letter

Dear Sirs,

I recently pulled my Experian credit report and there is a judgment that I noticed that was satisfied way back in 2008.

The reference number of this judgment on Experian is DC0012453.

There was a misunderstanding with the collection agency back then, and the judgment was paid in full by me.

Also, Experian is showing the wrong date of 2013. This is incorrect as it should be 2008.

I have been living with this on my report for years and never noticed it until now. Please investigate this immediately, as I would truly appreciate it.

Also in my investigation as I went through this report closely, I noticed that that the account CCB/PPC was charged-off in 2017. I do not recognize this account and I have no idea why it is being reported on my credit file.

This is very misleading information that can really hurt my chances of establishing more credit when I need it.

Attached is a copy of my drivers license, and a recent phone bill.

Please let me know if you need anything else from me.

I can be reached at 732-402-4020

Sincerely,

James English

Leave A Comment