how to get out of debt

How to Get Out Of Debt Quickly without Making Extra Money Even If You Have Bad Credit

Getting into debt can sometimes happen at the worst most unexpected and inopportune times.

And anyone who has fallen into debt knows the feeling of hopelessness and helplessness that the stresses of being in debt can bring.

Sometimes you know exactly how it happened and sometimes it just happens over a period of time you really didn’t see it coming.

So if you are in debt right now, you know that you need to figure out a plan and you need to do something about it.

Of course, the most obvious angle is to just stop spending and try to pay down your debts but most of the time that is just not possible.

You know that feeling where one side of you says I can handle this and I’ll take care of it and then the devil’s advocate part of you says oh my God what am I going to do. It is not uncommon to fight these two feelings.

It’s not something that we truly want to face and let’s face it fallen behind on your bills and getting into debt can be embarrassing.

But Fear Not | Getting out of Date is Not Far Away!

You are in the right exact place at the right exact time for some serious solutions on how to get out of debt quickly.

We have found a program that allows you to get out of debt with you making the same exact amount of money and where you continue living in the same exact lifestyle that you living right now.

Yes, you heard that right!

This program is absolutely magnificent.

And the best part is that it can help you to get out of debt including all debts. When we say all debts, we mean your car payments, your mortgage and all of your credit card debt.

In most cases, this solution can get people out of debt anywhere from 2 to 7 years depending on the amount of debt that they have.

If you are able to come up with extra funds during the process can get out of debt even quicker.

We are going to start with our first recommendation and how you can get out of debt quickly.

Our #1 Pick For the Best Way to Get Out Of Debt with No Extra Money and Less Than Perfect Credit

The Money Max account is a professional debt elimination software that was created by the owners of United Financial Freedom.

Here is how the Money Max Account Works

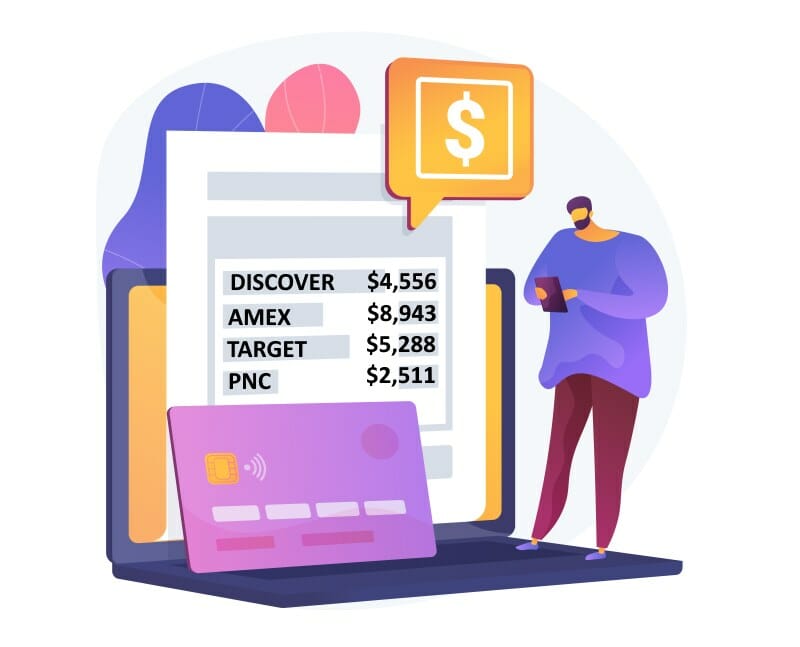

All you have to do is plug in your financial information which would include a list of your credit cards, the amount owed on the credit cards, the interest rate of those credit cards, and the due dates of those credit cards.

You will also add in the information for any loans and mortgages as well as other living expenses including telephone bills, car payments etc.

A Money Max Account agent will even do it for your help you to do it.

Once you plug in all of your information the program shows you how long exactly will take you to get out of debt with an exact debt payoff date.

If emergencies happen, and you need to use a credit card, you just simply plug that information into the software and it will re-strategize and reevaluate your situation and then recalculate your debt payoff date.

Then the program uses its sophisticated algorithms and tells you exactly what to pay and when to pay it based on the information that you provided.

It goes over many different scenarios and variables and figures out how you can make larger payments a higher interest rate cards and regular payments on lower interest rate cards.

And it works without you making any additional income!

They do not have to rob Peter to pay Paul to use this program and get out of debt.

It gets very exciting as you start using the program and you start to see your debt payoff date become a reality.

See our full review of the Money Max Account.

Let’s Put This in Perspective Now

The average person that owns a home will have a 30-year mortgage. And the average person will have around $30,000 in credit card debt.

In this common scenario, the average individual will never get out of debt. Most homeowners will take the whole 30 years to pay off their mortgage and some a lot longer because many refinance and building alone on top of the principal start over with another 30-year term.

The bank’s structure loans with the least amount of principal coming off the loan in the first few years by design.

This is called frontloading the interest so that when you first get a mortgage you’re really paying interest and hardly any principal the first 5 to 7 years.

As you can see in the scenario where a consumer has a 30-year mortgage, it will most likely take them 30 years to pay it off and they will never get out of debt.

With the Money Max Account, it can reduce the amount of time of 30 years down to 2 to 7 years of paying off your debt.

Is This Too Good to Be True?

We know what you’re thinking. It sounds too good to be true.

Well so did a lot of things in history before we really got to understand them. If you told your ancestors back in 1850 that they would be able to communicate with anyone across the world with a device held in your hand, they would say that you are crazy and that it was too good to be true.

The Money Max Account is real and it does work. It is unlike any other debt elimination software that we’ve ever seen as it tells you exactly what to do.

You do not have to think about scenarios where or when to make payments as the software does it for you.

Are you ready for the best part?

Not only does the software that you out of debt, but it also helps you to build wealth at the same exact time.

As you pay down your cards and you have a little bit of extra money available, you will learn exactly what to do with that money to build wealth.

When you sign up for the software you get lifetime customer support.

Get your FREE Debt Payoff Date Analysis today. Or read our full in-depth review of the Money Max Account and how it works.

Find out how long it will take you to get out of debt!

It’s 100% free and you do not need a credit card to find out your debt-free date!

Here Are Some Tips on Facilitating Yourself Getting Out Of Debt Quicker

Use these tips to help your cause by saving money where you can.

Say no to cable – Most people pay upwards of $200 for premium cable. With our lives being so busy now we don’t need to spend that kind of money on TV entertainment.

Cut down on entertainment expenses – Find free things to do in the area like going to free concerts, museums, and events. You can also try to stop going out to eat as much.

Stop borrowing money – Try not to use your credit cards. If you can’t truly afford something at the moment, hold off on it. After you use these strategies to finally get out of debt, you can then you can start to use your credit cards again.

Track and budget yourself – Track how much you’re spending and then budget yourself. Many people do not even balance their checkbooks anymore. A great way for you to get out of debt is to know exactly where your money is going. Once you understand that, create a budget and cut back on as many expenses as you can. You can then use that money to pay down your debts quicker. Keeping track of what you’re doing is very easy to do it also makes you very aware of the frivolous spending that you may be doing.

Transfer your balances –Transfer your high balances to zero or low-rate credit cards. If you’re able to do this it can alleviate that much unwanted interest so that you can have extra money to catch up on payments on other high-interest rate cards. You can also call your creditors and ask them to lower interest rates.

Here Are A Few Other Ways to Get Out Of Debt That We Recommend With Caution | If You Cannot Follow through with Caution Then We Do Not Recommend These

If you are careful, these next few strategies can certainly definitely work to help you get out of debt quickly and easily. But you have to make sure that you don’t make mistakes when executing these strategies.

Debt Consolidation Loan

A debt consolidation loan would work perfectly if you consolidated all of your debt into one fixed monthly loan payment at a lower interest rate. The problem with this solution is that if you are not careful you start using your credit cards that you have transferred the balances off of you will start building up debt again.

We have seen it so many times where people have a false sense of security after they have transferred the balances off of their credit cards and have no balances that they can use the cards sporadically again. What ends up happening is you start overspending and you start building up balances on these cards again.

If you are able to hide the cards in a draw and just use one or two for emergencies only and pay down your consolidation loan as quickly as you can with overpayments then this option will work.

This next solution we do not recommend | Why debt settlement is not the best choice to get out of debt

Again, if executed properly debt settlement program can help get you out of debt, but you have to make sure you understand the potential consequences of what could happen strategy there are certainly definitely inherent risks.

Debt Settlement

Although debt settlement can be an effective strategy, it is not recommended for the weary. When you enter into a debt settlement agreement you’re given the opportunity to pay less than you originally owed on your debt to resolve it but there are drawbacks. Let’s say you have a $10,000 debt and you negotiated a deal to make one payment of $2,500 to settle that debt, on the front and it looks like you got a great deal and only had to pay 25% originally owed. But the drawback is that the creditor will not be fully satisfied and will report this negotiation on your credit report.

How Debt Settlement Works

You hire a third-party debt settlement company to contact your creditors and negotiate payment plans to reduce your debt. Understand that these third-party companies will charge you a fee for doing this when you can actually do it yourself. They then instruct you to open up an account in escrow where you will put money in to pay that negotiated debt. In many cases, the company will instruct you to stop paying your creditors until they can reach an agreement for you.

Then they eventually hopefully may reach an agreement and in many cases, they will not be able to reach an agreement after you have stopped making payments.

As you can see this can backfire on you very quickly because the creditor is going to report the negative activity on your credit reports and will have an adverse effect on your credit and your credit score.

Also when you stop making payments you can incur interest and late fees.

The option of debt settlement is risky but there are times when it can work. If you are successfully able to negotiate your debts you could pay lower debt amounts on each debt and pretty much have the harassment creditors coming after you alleviated.

Be very careful if you are considering debt settlement as an option.

Bankruptcy

While filing for bankruptcy is known to be a very effective strategy to get out of debt while providing consumers with starting afresh life with a clean slate, it does have its drawbacks.

The first is that when the court issues a public record of your bankruptcy anybody can find out information about you in the future obviously because it’s a public record.

The bankruptcy will also show up on your credit report for a minimum of 10 years. If you already have a really low credit score, then this is not as bad as it looks because you’re going to have to rebuild your credit anyway. But if you have good credit, this will drastically affect your credit rating and trustworthiness, and of course, your score will drop drastically.

Not everybody is eligible to file for bankruptcy. Were just going to list that here as a drawback as well.

You might have to give up some items that you own when filing for bankruptcy. In most cases, you won’t have to but every case is different.

If you file for a chapter 13 bankruptcy instead of a chapter 7 bankruptcy, you’ll probably have to pay back some of your debts on a payment plan.

Still with all of that said, filing for bankruptcy can be beneficial for your situation and can help you to get out of debt very quickly.

Chapter 13 bankruptcy can also help to stop foreclosure.

Huge companies get bailouts all the time. So why shouldn’t you take a personal bailout?

Make sure you consult the laws with a professional before making any decisions. There are different kinds of bankruptcies and there are different kinds of loopholes and situations you may not be privy to.

Make sure you do your due diligence and talk to a lawyer if you are considering your debt settlement or bankruptcy as a solution to getting out of debt.

See our resource on how to get a bankruptcy removed from your credit report.

Our Final Thoughts

If you are looking for solutions on how to get out of credit card debt fast or how to get out of debt on a low income then we would recommend that you sign up for a Money Max Account and get a free debt analysis to see how long it will take you to become 100% debt-free.

The Money Max Account Software is a remarkable actionable solution to becoming debt-free very quickly.

The Money Max Account is our #1 choice for consumers to become debt-free in the least amount of time.

It works without the consumer having to make any lifestyle changes and without the consumer having to come up with additional assets or income.

Once you sign up for the software you get lifetime customer support.

The software also helps you to build wealth while eliminating debt

You can use the software over and over for managing investments.

This is one product that we fully endorse where consumers can pay off their mortgages and other debts in as little as 5 to 7 years on average if they use due diligence and use the software correctly and work hard at the goal of becoming debt-free.

Other Related Resources

See over 130+ ways to get out of debt, how to save money and how to make money as well.

Read our review of the Money Max Account and see how it works step by step. Learn how to pay off your debt in as little as 2 to 5 years.

Check out our all-new guide to getting debt help. Don’t go at it alone, help is right around the corner!

Learn how to pay off your mortgagein 2 to 7 years.

If you need help getting out of debt, try using debt elimination software.

Here is a list of dozens of money affirmations that work fast that will help to bring money into your life immediately.

See our picks of the best credit repair companies.

If you want to cut right to the chase, here is our choice for the #1 credit repair company.

If you decide to choose to file for bankruptcy, see our in-depth guide on how long it takes to recover from bankruptcy. Also learn the pros and cons of filing either a Chapter 13 or Chapter 7 bankruptcy. There are tips on rebuilding your credit and improving your score after bankruptcy.